There has been a lot of commentary recently that inflation is leading to people cutting back and buying cheaper products in FMCG. The evidence is that this is not the case.

In fact more “normal service” is being resumed after the last 2 years – as shown in last week’s edition on overall purchasing. Here we look at the real drivers of Discounter and Private Label trends.

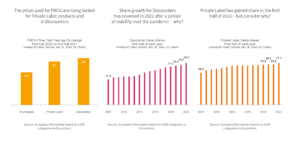

The prices paid for FMCG are rising fastest for Private Label products and in Discounters

Because of the lower price base, passing on a similar cost increase on Private Label products and in Discounters leads to a higher percentage increase. This has the consequence of higher inflation for households who are most likely to buy PL or shop in Discounters.

Share growth for Discounters has resumed in 2022 after a period of stability over the pandemic – why?

Discounter share growth had slowed in 2020 and 2021 as shoppers moved online, shopped less often with large basket sizes. Meanwhile stores continued to open and prices paid, as we have seen, are rising faster than average. Therefore the long term share trend up to 2019 has resumed.

Private Label has gained share in the first half of 2022 – but consider why!

After a period of Private Label share stability, growth has returned in 2022. Underlying this, Discounters, with high PL shares, have grown by a share point (see above) and PL price increases are higher than the market average. These two factors account for most of the share increase.