Penetration: a metric that matters

Lots of questions last week on the relevance of penetration as a growth KPI. We share some recent findings and a look back at our “Once is not enough” project.

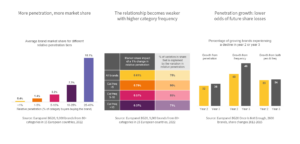

More penetration, more market share

Our analyses over recent years have consistently highlighted the critical link between market penetration and market share. Simply put, to achieve high market share, a brand must reach a broad audience of category buyers. The data underscores this: brands reaching 1-5% of category buyers typically hold a market share of 1.4%, while those reaching 25-40% achieve an average share of 19%. Although the relationship between penetration and share isn’t exactly one-to-one, relative penetration remains a crucial metric for assessing market success.

The relationship becomes weaker with higher category frequency

This relationship is particularly strong in categories purchased infrequently. If all buyers purchased a category only once within a given period, volume share and penetration would align (assuming consistent pack sizes). In categories with higher purchase frequency, buyers have more chances to buy multiple brands, meaning each additional penetration point translates to a smaller share gain. Consequently, the relationship’s explanatory power diminishes as other factors, like purchase frequency and amount bought, become more significant. Therefore, focusing solely on market share provides an incomplete picture. It is essential to also track its components: buyer numbers, purchase frequency, amount per occasion, and price paid if value share is the focus.

Penetration growth: lower odds of future share losses

In our “Once is not enough” research initiative conducted several years ago (link see below), we analyzed brands that grew through either penetration gains (about 30%), frequency gains (about 10%), or both (60%). We then tracked the performance of these winning brands over the next two years. Our findings revealed that two-thirds of brands that gained share via penetration continued to grow, whereas half of the share winners through frequency gains alone lost share. This indicates that tracking penetration is not only crucial for current success but also predictive of future growth.

If you want to learn more, please visit https://visionplatform.europanel.com/once-is-not-enough/