Pricing and how it relates to winning share during Covid-19, inflation and recession

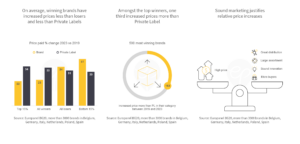

On average, winning brands have increased prices less than losers and less than Private Labels

The past four years were characterized by health crises, political turmoil and levels of inflation not seen for decades. These circumstances have hurt real incomes and consumer confidence. No surprise Private Labels have gained share more quickly than during the 2010s. Also, winning brands (in terms of market share) have increased prices less than their losing peers and also less than Private Labels in their category. On average it is obvious that relatively bold price increases did hurt market shares.

Amongst the top winners, one third increased prices more than Private Label

As we know, averages often hide interesting patterns and lead to generalizations which may not withstand closer inspection. Indeed, amongst the 500 most winning brands (in terms of share), 1 in 3 did increase its price more than the Private Labels in their category. In other words, being careful with respect to charging higher prices seems promising in times like these – but it’s not necessary.

Sound marketing justifies relative price increases

How did these 163 brands pull off winning share despite increasing prices more than PL?

They followed all the “rules”:

- finding more buyers (penetration up +3.8% on average)

- small decline in frequency (but that was a common theme for all brands in those years because shopping trips are down)

- massive increase in distribution (from 55% to 68% on average)

- increases in assortment size

- better innovation: while they did not launch more than other winners, their launches accounted for a substantially higher share of brand sales.