Growth of brands in Europe from 2019-2023 – Part 1

Learnings from 16 countries

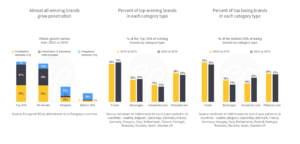

Almost all winning brands grow penetration

Among brands that gained vs lost share from 2019 to 2023 we see that almost all winners increased reach (88% among the Top 20% and 77% among all share winners) while hardly any share-losing brands managed to grow their buyer base. The number of winning brands that grew frequency is only about half, but keep in mind that we saw a decline in the average category purchase frequency throughout that period.

Percent of top winning brands in each category type

We compare two four year periods (2015-2019 and 2019-2023) to examine whether the composition of categories where the Top 20% winning brands compete have changed. The make-up of top performers is quite stable: we see a small increase in the share of food and beverage brands in this group while the share of household care and personal care brands is down. Overall winning brands’ distribution across category types is rather stable.

Percent of top losing brands in each category type

The composition of the Top 20% losers shows more change: in this case the share of both food and beverage brands has declined a bit, but substantially more household care brands have seen their market shares drop substantially while personal care brands are as prominent in this group as they were in the previous four-year period.