Growth of brands in Europe from 2019-2023 – Part 3

Another set of learnings (for now) from 16 countries

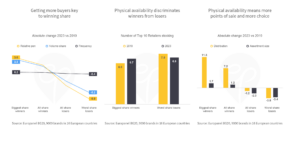

Getting more buyers key to winning share

A common theme over the past ten years of reporting BG20 insights has been the importance of penetration growth as an essential prerequisite for share growth. This has not changed over the past five years: share winners have increased the number of households buying them (and also the frequency with which they buy) while share losers experienced a drop in buyer numbers and frequency.

Physical availability discriminates winners from losers

Brands gaining share from 2019 to 2023 also increased their physical presence by becoming available in more retailers. Amongst the biggest share winners availability in the Top 10 retailers increased from 6 to 6.7 on average – while the top share losers experienced a decline of about the same magnitude.

Physical availability means more points of sale and more choice

Share winners differ from share losers both with respect to the change in distribution (that is, the market share owned by the retailers where they are listed) over the same time period and the change in assortment size. The conclusion: easier to find and more options to choose from links to share growth. Note that losers do not innovate less – but they replace rather than add to their assortment.