Price War – Love it or Leave it

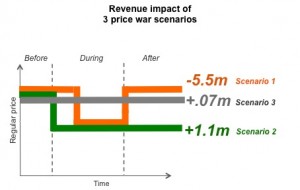

Retailer-initiated price wars are a popular strategy to battle for market share. When in October 2003 Dutch retailer Albert Heijn announced price cuts for more than 1,000 branded products, its main competitors reacted immediately by matching or even besting these reductions. An empirical study has now investigated the impact of this Dutch price war for 162 brands in 25 categories at 5 retailers over a period of nearly 5 years (one year before, 2 years during and 2 years after the price war). One key learning: Such full-out price wars rarely lead to substantial changes in brands’ revenues, volume sales or shares. However, the price positioning following the price war makes a big difference. This is illustrated via three scenarios (see figure).

Retailer-initiated price wars are a popular strategy to battle for market share. When in October 2003 Dutch retailer Albert Heijn announced price cuts for more than 1,000 branded products, its main competitors reacted immediately by matching or even besting these reductions. An empirical study has now investigated the impact of this Dutch price war for 162 brands in 25 categories at 5 retailers over a period of nearly 5 years (one year before, 2 years during and 2 years after the price war). One key learning: Such full-out price wars rarely lead to substantial changes in brands’ revenues, volume sales or shares. However, the price positioning following the price war makes a big difference. This is illustrated via three scenarios (see figure).

Scenario 1: Late price drop and price is restored after the price war ends

Such brands face the most substantial losses because they appear less price attractive at the start of the price war and also immediately afterwards (average revenue loss: – 5.5m)

Scenario 2: Immediate drop and price remains the same after the price war ends

Such brands can obtain considerable revenue gains (average: +1.1 Mio), because they improve their relative value perception twice – at the potential risk of losing consumer brand equity

Scenario 3: Stay out of the price war

This strategy results in neither a revenue gain or loss over the full study period

Possible gains during a price war are greater for economy brands than for premium brands, whereas after the price war, premium brands tend to profit more heavily from decreased prices.