Innovation matters

This week we show that innovating companies are more likely to grow and that winning brands are more likely to innovate.

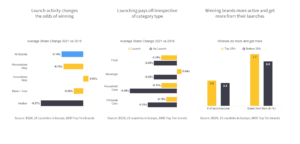

Launch activity changes the odds of winning

The average Top 10 brand in Europe lost 0.14% share between 2018 and 2021, mostly because of PL winning share. Over that period, three in ten Top 10 brands were inactive with respect to new products reaching the shelf.

For this group of brands the loss was twice as large than for active brands. Launching innovations, (i.e. new products that justify the creation of a new sub-brand, are therefore more likely to be more innovative) was the most effective way to defend share.

Launching pays off irrespective of category type

Whether a brand competes in Food, Beverage, Household Care or Personal Care, the same pattern persists: Brands that launch outpace their non-launching peers. The difference is most pronounced in Household Care and least pronounced in Food categories. Note that the change in shares shown hides a lot of variation – and that many other factors contribute to this outcome.

If you want to learn more about drivers of brand growth and how your brands benchmark, please get in touch.

Winning brands are more active and get more from their launches

When comparing the top 25% of brands in terms of market share change with the bottom 25%, there are some striking differences with respect to launch activity and success: The top quartile launches more but also gets more of its sales from these new products. Because we have shown before that successful brands are also more likely to keep their existing assortment on retailer shelves (i.e. launches do not only replace existing SKUs), winners’ launches seem to meet shopper expectations better than losers’ launches.