Private Labels build retailer loyalty … to a point

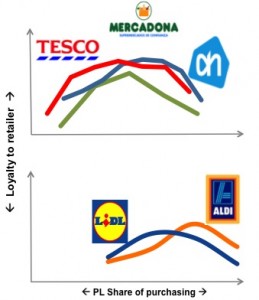

A few years ago we confirmed academic studies* showing that the relationship between a household’s PL share at a given retailer and the share of wallet going to that retailer follows an inverted U-shape: loyalty increases to a certain point but falls again once a level of about 40% private label buying is reached. The figure shows that this pattern holds for shoppers in Spain at Mercadona, in the UK at Tesco and in the Netherlands at Albert Hejn.

A few years ago we confirmed academic studies* showing that the relationship between a household’s PL share at a given retailer and the share of wallet going to that retailer follows an inverted U-shape: loyalty increases to a certain point but falls again once a level of about 40% private label buying is reached. The figure shows that this pattern holds for shoppers in Spain at Mercadona, in the UK at Tesco and in the Netherlands at Albert Hejn.

For this blog we examine this pattern for discounters. Does the same relationship between PL share and store loyalty exist for Lidl and Aldi in the UK? Not surprisingly, the curve shifts to the right given these formats’ higher reliance on Private Labels, but the inverted U-shape remains. People buying more than 90% PL are less loyal to Aldi and Lidl than shoppers buying slightly more branded products.

Different types of consumers may explain this shape:

Retail Brand Foes: consumers buying no PL at all may lack the necessary loyalty to the retail brand

Retail Brand Fans: consumers purchasing some PL from a chain are likely to trust the store and be loyal, but only to a point

Deal hunters: consumers shopping around for the best price may be very prone to buy PL (and deals), but do so at many stores.

These results make a strong case why retailers should not push private labels in their assortment beyond certain limits.

*Ailawadi, Kusum L., Koen Pauwels, and Jan-Benedict E.M. Steenkamp (2008), “Private Label Use and Store Loyalty,” Journal of Marketing, 72 (November), 19-30.