During the pandemic, shopping frequency fell and basket size increased.

Is this still the case and how have Discounters and Private Labels developed in the wider European context?

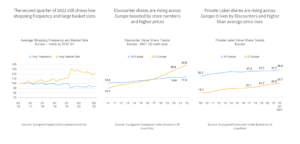

The second quarter of 2022 still shows low shopping frequency and large basket sizes

The pandemic led to less shopping around, fewer store visits and very large basket sizes in a record FMCG market. Despite the rise in Discounter shares and although there is country variation, on average both behaviours carry over into the middle of 2022 – inertia, continuing covid concerns or fuel costs or all three?

Discounter shares are rising across Europe boosted by store numbers and higher prices

The pandemic slowed Discounter progress in W Europe but has been consistent in E Europe alongside store number increases. The effect of new stores opened since 2019 in W Europe are now taking effect – and in both regions higher than average % price rises are also driving share.

Private Label shares are rising across Europe driven by Discounters and higher than average price rises

Discounters hold a much higher Private Label share than average and so the rise in Discounters is a key reason for PL share increases. Added to this, PL prices are rising faster than average in % terms.