Brand Price Premia and Private Label Success

Private labels usually benefit from worsening economic conditions because these put (actual or perceived) pressure on consumers‘ budgets. Buying more Private Labels, which on average are just a little more than half the price of their branded competitors (see last month‘s blog), is an obvious solution. Indeed, various scientific papers show that Private Label growth in contractions is systematically higher than in expansions.

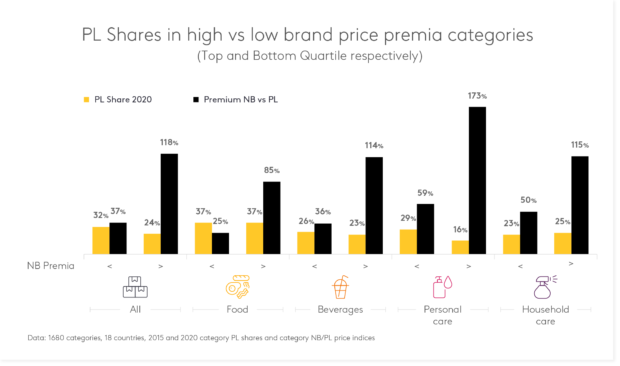

The simple answer for National Brands could be to reduce the price premium vis-à-vis Private Label. Too simple? We examine whether the gap between NB and PL prices in a category is related to PL shares. The chart compares the most expensive categories (in terms of price distance versus PL) to the least expensive ones and distinguishes between different category types. For example, national brand prices in the relatively most (least) expensive beverage categories are at least 114% (at most 36%) higher than PL prices. The average PL share in the expensive categories is 23%, compared to 26% in the cheap categories.

The pattern is similar across all category types – while the cut-off price premia that define the respective quartiles differ (e.g. much higher in Personal Care), the categories where NB are relatively more expensive often boast lower PL shares (similar shares in household care and food) . Our conclusion: People will choose what provides them with better value. In categories where NBs deliver (through perceived quality, trustworthiness, innovation or symbolism) they capture high shares in spite of relatively high prices. In categories where they don’t, people are more likely to prefer PLs in spite of the low premia that NBs are charging.

Is this outcome a fate defined by the category you compete in? See our blog next month where we investigate whether the same categories show similar PL success across countries.

Data: 1680 categories, 18 countries, 2015 and 2020 category PL shares and category NB/PL price indices