Category share-of-wallet

A closer look at categories which capture large vs small budgets

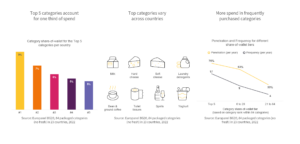

Top 5 categories account for one third of spend

Shoppers allocate about one-third of their budget to just five categories out of the 84 packaged goods categories covered in our Europanel BG20 database. This includes 34 food, 22 personal care, 15 beverage, 9 household care, and 4 pet food categories. Across 23 countries, the most valuable category captures nearly 10% of shoppers’ budgets, while the Top 10 categories account for about half of total spending (again, the base is 84 categories, not all FMCG spend).

Top categories vary across countries

The leading category in terms of spending varies by country. In most countries, the top spots are often occupied by food categories, with dairy (cheese, milk) being particularly prominent. Other categories frequently appearing in the Top 3 include sweet biscuits, coffee, mineral water, skincare, spirits, and laundry detergent. There are significant differences between countries in how budgets are allocated across categories. Are you aware of these variations, and can you address the reasons behind the prominence of certain categories?

More spend in frequently purchased categories

Brand size is primarily determined by the number of shoppers a brand reaches, as frequency tends to vary little between brands. However, category size is influenced by both the number of buyers and their purchase frequency. The Top 5 categories in terms of spending have more than twice the number of shoppers and a shopping frequency over four times higher than categories outside the Top 20 categories. Next week, we will compare these category spend tiers in terms of assortment size, launch activity, and private label success.