Big brands keep more buyers

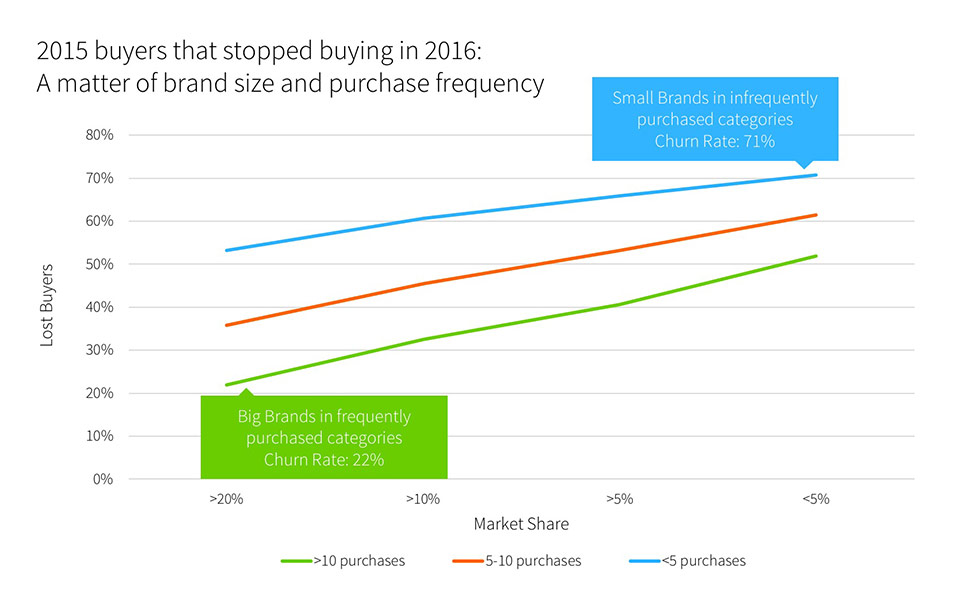

One way to assess loyalty in FMCG is the ability to keep buyers from one year to the next. Given the massive choice, abundance of promotional offerings and assortments as well as retailer variation, there is a steady flow of buyers starting and stopping buying a brand. Looking at more than 15,000 brands in 31 markets and 86 categories, the level of consumer churn is closely linked to brand size and category purchase frequency.

Small brands in infrequently purchased categories are subject to highly volatile buyer bases: Such brands must expect to lose 70% of this year’s buyers next year, a loss that is compensated by a similar percentage of new buyers (i.e. they have not bought the previous year).

Small brands in infrequently purchased categories are subject to highly volatile buyer bases: Such brands must expect to lose 70% of this year’s buyers next year, a loss that is compensated by a similar percentage of new buyers (i.e. they have not bought the previous year).- Big brands in frequently purchased categories also experience churn, but their shopper base is much more stable. The average big brand in frequent categories loses only 20% of its buyers every year – a result of more frequent category exposure and higher availability (mental and physical).

- Market share changes are also reflected in churn changes over time: Share winners between 2013 and 2016 saw their churn rate drop by 4% while share losers experience a 3% increase in their churn rates.

While size and category frequency largely determine the stability of a brand’s buyer base, changes in churn go hand-in-hand with a brand’s share trajectory. Understanding which types of activity impact churn rates (by category and brand status), but also given a specific price or distribution strategy is therefore critical.