Retailer presence & market share

In FMCG, brands largely still rely on retailers to find their way into the baskets of shoppers. To understand the relationship between the number of retailers where a brand is available and its market share, we looked at the physical presence of 13,671 national brands at the top 10 retailers in 22 countries. On average, the top ten retailers account for slightly above 70% of the value sales of these 13,671 brands.

Share Impact

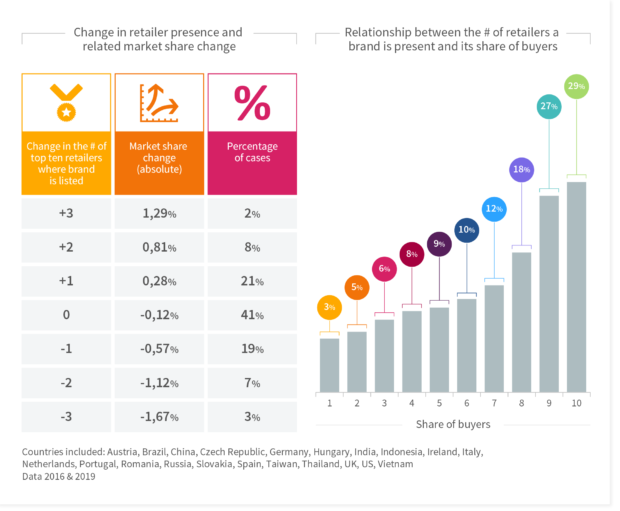

The more retailers in which a brand is available, the higher its market share. For example, brands listed at one retailer only reach an average market share of 2% in 2019. Brands listed at 5 retailers have a share of 5%. Brands available at 8 retailers or more benefit from a larger physical presence and on average attain 10% market share or more – and 16% if a brand is listed in all top 10 retailers

Changes over Time

Taking a dynamic perspective (2019 vs. 2016) we find brands losing retail presence experience a share decline and brands gaining retail presence win share. Massive shifts in retailer presence are rare – 80% of all top ten brands have a stable presence or were added to (or dropped from) the assortment of one retailer only. (see table on the left)

Impact Penetration

Like with share, the average penetration (i.e., share of buyers) increases with the number of retailers where a brand is listed. We find the biggest jump in average penetration occurring when a brand is available in 8 (vs 7) or 9 (vs 8) retailers (see figure on the right). It seems like there is a threshold in physical presence beyond which a brand’s availability more strongly results in choice.

Countries included: Austria, Brazil, China, Czech Republic, Germany, Hungary, India, Indonesia, Ireland, Italy, Netherlands, Portugal, Romania, Russia, Slovakia, Spain, Taiwan, Thailand, UK, US, Vietnam

BG20 Data 2016 and 2019