The main Food and Beverage ‘super-categories’ continue to perform well compared with pre-pandemic – and those that are increasing volumes are driven by attracting more buyers.

The rules of growth remain true over this Covid and Inflationary period.

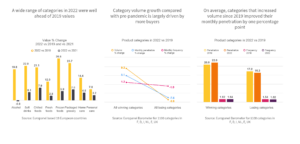

A wide range of categories in 2022 were well ahead of 2019 values

Compared with pre-pandemic, – all ‘super-categories’ show value growth but several were ahead of inflation to be significantly higher in value in 2022 – Soft Drinks, Chilled, Frozen and Packaged Grocery.

Category volume growth compared with pre-pandemic is largely driven by more buyers

Despite the pandemic and inflation, the rules of growth remain the same. To get volume growth a category needs more buyers and this leads to slightly higher buying frequency. All players in a category, Brands and Private Labels, should be aiming to increase buyer numbers.

On average, categories that increased volume since 2019 improved their monthly penetration by one percentage point

Growing categories increased their average monthly penetration to 22% along with a small rise in buying frequency. Categories with reduced volumes were the opposite. The importance of category penetration is clear if brands and retailers are to operate in a dynamic environment.