More on the longer term implications of inflation and economic downturn

How do we now see the FMCG market developing? How does shopper choice change? And how can manufacturer brands counter these changes?

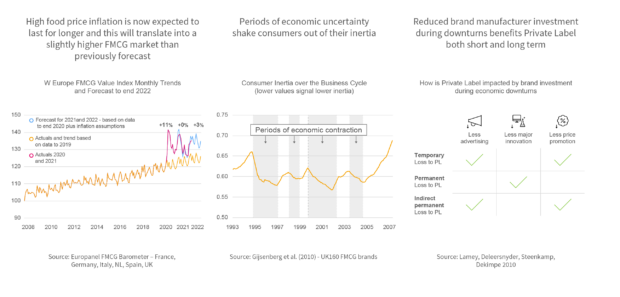

High food price inflation is now expected to last for longer and this will translate into a slightly higher FMCG market than previously forecast

Inflation is now expected to remain high until the Autumn and early Winter. Although shoppers are down-trading to cheaper items, much of the price rise will feed into FMCG value and the full year expectation is increased to +3% vs 2021. This and continued working from home means that the market remains much higher than pre-Covid expectations.

Periods of economic uncertainty shake consumers out of their inertia

During times of uncertainty, price becomes a more important factor and choices are less stable than usual. After the downturn, normal service is resumed – but the inertia is transferred to the new favourite set of items. Investment is critical during the downturn.

Reduced brand manufacturer investment during downturns benefits Private Label both short and long term

Less investment by brands in major new products during periods of uncertainty leads to a permanent loss of share to PL. Less advertising and promotion has a temporary effect but also leads to long term effects by increasing shopper sensitivity to price during contractions.