Brand price premium varies substantially

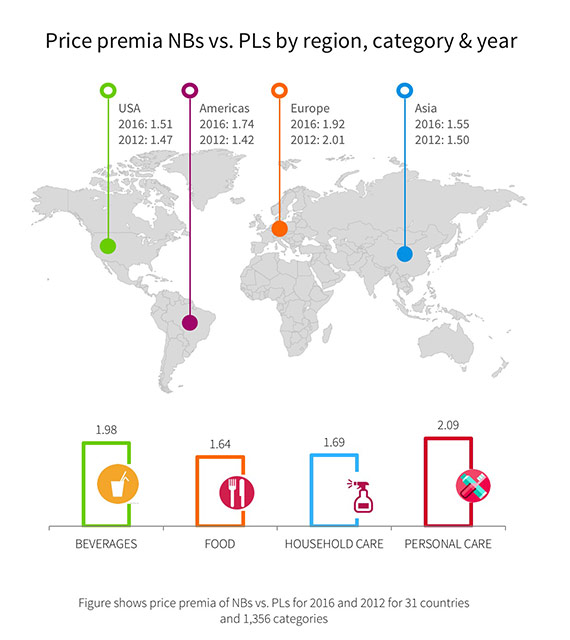

Private labels (PL) challenge national brands by taking away sales, eroding consumer brand equity and squeezing price levels. However, national brands (NB) continue to capitalize on their equity and charge on average 1.8 times the price of their PL counterparts. This price premium is more pronounced for brands in personal care where NB prices are twice as high as prices for PLs. However, the price premium for national brands is more moderate in food and household care.

Private labels (PL) challenge national brands by taking away sales, eroding consumer brand equity and squeezing price levels. However, national brands (NB) continue to capitalize on their equity and charge on average 1.8 times the price of their PL counterparts. This price premium is more pronounced for brands in personal care where NB prices are twice as high as prices for PLs. However, the price premium for national brands is more moderate in food and household care.

Categories that feature high NB prices include, for example, hair colouring products, razor blades, shaving foams and body creams – all categories where, in spite of relatively high prices, NB share is also above average. On the contrary, the price premium and shares of NBs are both relatively low in categories like canned beans, instant coffee, butter or kitchen paper.

NBs in Europe achieve the highest price premium followed by the Americas and Asia. In Europe, the average NB price is nearly double the average PL price. Over the past five years NBs increased their price premium in all regions except Europe.

Analysis is based on 2012 and 2016 data for 31 countries and 1,356 categories.