FMCG value development in Western Europe has been turbulent in recent years

Strong volume gains during the pandemic, followed by downtrading on price and volume because of high inflation levels

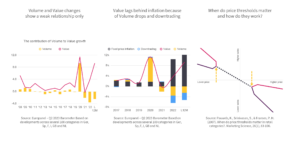

Volume and Value changes show a weak relationship only

Over the past 15 years the relationship between FMCG volume and value changes has been modest. While for many years this was a consequence of very stable volumes, the pattern has changed dramatically since 2020: One year where massive volume gains explained value growth, while in the latest two years value spiked in spite of substantial volume drops.

Value lags behind inflation because of volume drops and downtrading

While recent value growth matches the record numbers we saw in 2020, the underlying pattern is very different. Without pandemic lockdowns but other reasons to worry, consumers reduce the amounts they buy and increasingly turn to cheaper options (private labels, promoted items). Make sure you offer value for money irrespective of your price point – now is a time where consumers will consider the price of their choices very carefully.

When do price thresholds matter and how do they work?

Across categories and consumers the usually negative relationship between sales and price differs (depending, for example, on the category’s importance, social symbolism or the consumer’s income). But even for a brand, this relationship can be quite complex: constant for a certain price range, but quite different outside. Understanding where your brand’s sensitivity to prices is most/least pronounced is critical, especially in times where price matters a lot to consumers.