The stability of brand ranks in terms of volume share over time, more precisely pre- vs post- COVID, is the focus of this week’s analyses.

How many brands’ rankings were maintained, improved or worsened?

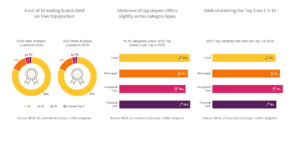

8 out of 10 leading brands held on to their top position

Out of roughly 1000 category-leading brands across 12 countries in 2019, more than 800 were still the largest brand in the category 3 years later. Less than 2% of the #1 brands in their category in 2019 dropped out of the Top 3. The odds of reaching the top spot from outside the Top 3 are equally tiny. Of all leading brands in 2022 less than 2% were not part of the Top 3 in 2019.

Stickiness of top players differs slightly across category types

The stability of the top position in a category between 2019 and 2022 is high irrespective of category type. While leading brands in Food and Personal Care were most likely to keep their top spot between 2019 and 2022 (84% of #1 brands held on to their top ranking), Household Care categories were the most likely to see a new brand leading the category in terms of volume share. Almost 1 in 4 leaders in 2022 replaced a competitor during the pandemic.

Odds of entering the Top 3 are 1 in 10

Large changes in brands’ positions are not very common: Of all brands ranked #4 to #10 in 2019 fewer than one in ten was able to crack the podium – irrespective of category type. The pathway to the top takes time, but it’s not impossible: 1 in 5 brands ranked #4 or #5 did enter the top 3, while only 1 in 30 manages that feat within three years from outside the Top 5. Investment in your brand will pay off, just don’t expect it to translate in massive gains quickly.