Part 2 in our Category Share-of-Wallet (SOW) Analyses

Differences between categories capturing large vs small parts of shoppers’ budgets

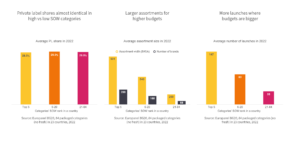

Private label shares almost identical in high vs low SOW categories

While one might expect retailers to focus more on their PL activities in categories where shopper budgets are higher, the actual PL shares (across 84 categories in 23 countries) tell a different story: the Top 5 categories in terms of shopper budgets boast (on average) an almost identical PL share when compared to the bottom categories – note however that the massive dispersion of PL shares hides a lot of variation (across countries and categories).

Larger assortments for higher budgets

Higher budgets attract suppliers‘ attention: in the Top 5 categories by share-of-wallet, both the number of brands and SKUs available to shoppers are significantly greater than in lower budget categories. Assortment sizes are more than four times larger for these top categories compared to the bottom tier. Coupled with last week’s findings, which showed higher reach and frequency of high share-of-wallet categories, this pattern highlights both a supply-side effect (for a manufacturer it is worthwhile to invest in a broader range and more manufacturers play in that category) and a demand-side effect (some consumers seek more variety as the number of purchase occasions increases).

More launches where budgets are bigger

Consistent with larger assortment sizes, high SOW categories also feature a greater number of new SKUs. However, the percentage of new products within the assortment remains relatively stable. In the Top 5 categories, new products account for 16% of the total category assortment (147 out of 931 SKUs). Similarly, in the bottom tier of categories, new products make up 18% of the assortment (36 out of 200 SKUs).