PL Success and Price Premia

In our post “Higher Price Premia for National Brands“ we showed that NB price premia over PLs have increased over the past three years. How this premium evolves is complex and could be impacted by the success of PLs in a category. A few possible scenarios emerge for high and low PL shares respectively:

- High PL shares put pressure on NBs and could force them to reduce price resulting in a smaller price gap. However, NBs may be worried about losing margin without share gains and resist price cuts.

- High PL shares are a signal of strong consumer acceptance of PL and could incentivize retailers to increase PL prices leading to a smaller price gap.

- Low PL shares could motivate NBs to increase prices to boost margins resulting in a more beneficial value perception for PLs because of a larger price gap.

- However, NB players may also seek to maintain low PL shares by avoiding higher prices.

- Finally, retailers may try to create PL acceptance in low PL share categories by more aggressively pricing their PLs and widening the price gap.

Given the various ways this could play out, let’s see how NB-PL price gaps have developed across more than 1,200 categories in 16 European countries over the past three years – dependent on the strength of PL in the category.

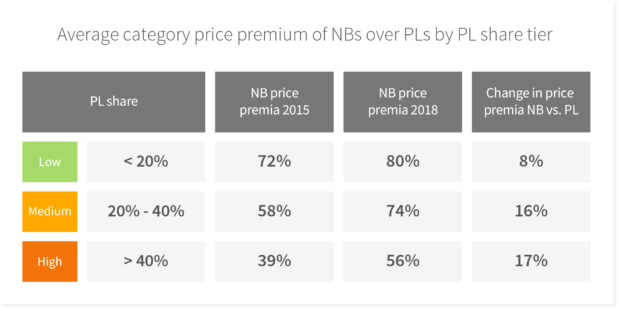

Overall, we find that higher PL shares are linked to lower price premia of NBs. PL has done well where brands have failed to provide good enough reasons to keep buying them and paying the higher price.

Overall, we find that higher PL shares are linked to lower price premia of NBs. PL has done well where brands have failed to provide good enough reasons to keep buying them and paying the higher price.- In all PL share tiers the gap between NB and PL price levels has widened. Interestingly, the higher the PL share in a category in 2018 the broader the gap has become.

- In categories with relatively low PL shares, the price ratio increased by 8%. This lends support to two possible driving forces: Either NBs are confident that shoppers prefer the manufacturer over the retailer brand and are willing to pay more. Or PLs are becoming more price-aggressive to overcome their relatively weak market position.

- In categories with a relatively high PL share, NBs price premia have increased even more (on average + 17%). Again, two explanations come to mind: First, brands in these categories are convinced that PLs have reached their potential and focus on increasing margins on comparably modest volumes. Second, retailers are confident that their ceiling is even higher in terms of share and continue to be price-aggressive.

It will be interesting to see how the larger price gap on average impacts the growth of private labels in total and, for specific categories, how price premia development and PL success relate to each other.

*Countries included: Austria, Belgium, Denmark, France, Germany, Hungary, Italy, Netherlands, Poland, Portugal, Romania, Russia, Slovakia, Spain, Sweden, United Kingdom

Data from 2015-2018