Listings affect buyer overlap

The degree to which brands share their buyers roughly follows the Duplication of Purchase law (see Andrew Ehrenberg’ seminal book Repeat Buying). The law says that a brand shares more of its buyers with larger brands than smaller brands. And two more factors increase overlap – a longer period of time and higher purchasing frequency of the category.

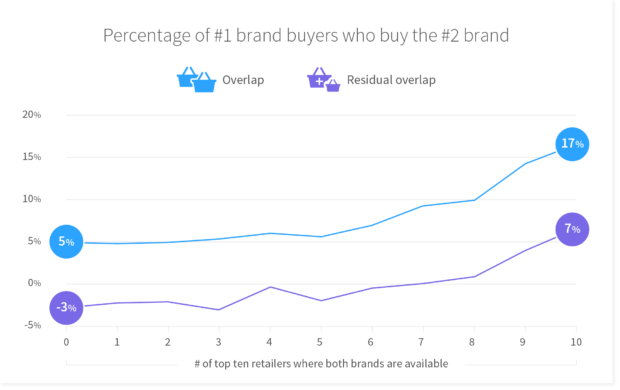

Our work on brand portfolios uncovers an additional factor that increases overlap – being available at the same retailers. We examined more than 3,000 brand portfolios across ten countries and focused on the buyers of the largest brand in the portfolio who also buy the second largest brand. Across all portfolios this number is 8%. This drops to 5% if the two brands do not share the shelf in any of the top ten retailers and goes up to 17% if the two brands are available at all ten. Even after controlling for brand size and category frequency the relationship remains strong (see line ‘residual overlap’).

Anecdotal evidence suggests that manufacturers offer portfolios to reach different buyers. If a manufacturer has multiple brands listed at the same retailer this impacts this objective. Of course, we don’t suggest avoiding co-listings but the phenomena presented here must be considered when evaluating and benchmarking buyer overlap between portfolio brands.

Residual Overlap: Overlap not explained by the size of the brands and category purchase frequency

Andrew Ehrenberg (1972): Repeat Buying – Facts, Theory, and Applications, North Holland Publishing Company.

Countries included: Austria, Germany, France, Spain Hungary, Ireland, Poland, Romania, Russa UK