Portfolio buyer overlap smaller than expected

Many manufacturers compete with more than one brand in a category hoping to be able to reach buyers that they could not reach with one brand only. A common management aim is to position brands in a portfolio to reach distinct buyer groups – and, implicitly, to reduce overlap. We define overlap as the number of buyers buying both brands in a portfolio (our analysis is restricted to two brand portfolios) divided by the buyers that buy either brand.

For example, a portfolio where brand A (B) is bought by 10 (5) persons respectively with 3 of these persons buying both brands has an overlap of 25% (3/(7+2+3)).

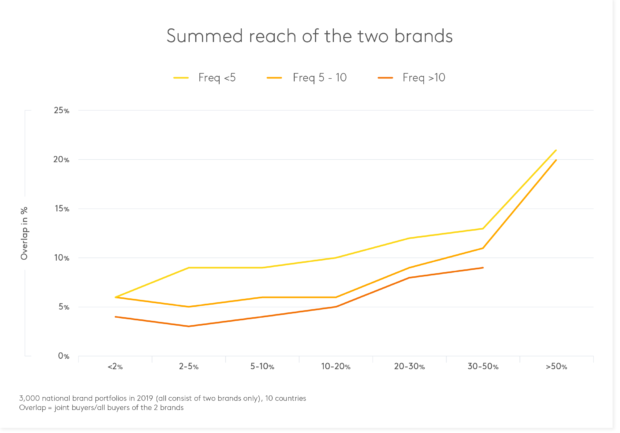

The diagram below shows that such overlap levels are rare. Typically fewer than 10% of the buyers of either brand in a two-brand portfolio buy both brands. However, several factors besides the successful targeting of specific buyer groups impact the actual level of overlap and must be considered when evaluating the reach of each brand in a portfolio:

- The bigger the two brands, the higher their overlap.

- The higher the purchase frequency in a category the higher the odds of purchasing any pair of brands (see diagram).

- The more brands in a portfolio the higher the percentage of buyers buying more than one brand (2% in the average two brand portfolio, 9% in the average 4 brand portfolio).

- The more joint listings two brands have, the higher the odds for both brands to make it into the same shopping basket.

- The more similar the price points the more likely two brands appeal to the same shopper.

- The more two brands appeal to the same benefit/socio-demo segments the higher their overlap.

Managers should examine how prevalent these factors are in their brand portfolios before judging whether a specific level of overlap is a reason for concern.