Brand portfolios & brand growth

7 in 10 brand portfolios have not changed their size between 2014 and 2019. Of the remainder, about the same number have added or removed brands from their portfolio. How have such decisions changed these manufacturers growth odds?

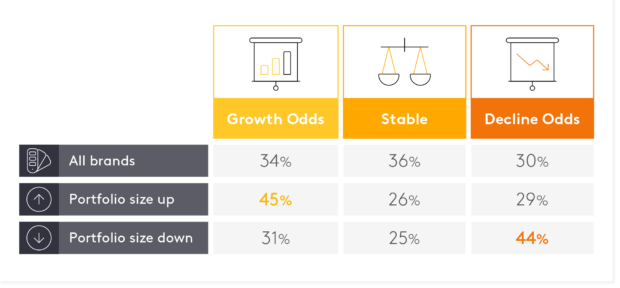

Of all portfolios 34% are growing (based on a threshold of 0.2% share gain over five years) and 30% are shrinking (threshold of 0.2% share loss). 36% have experienced share stability over these five years (note that this is based on the five-year change, ignoring any in-between share fluctuations).

Among portfolios that have increased their brand count, the percentage which grows is higher – 45% instead of 34%. However, the likelihood to shrink is almost the same as for all portfolios (29% instead of 30%).

Among portfolios that have pruned brand(s) from their portfolio the likelihood to grow remains largely unchanged – 31% instead of 34%. However, the likelihood to shrink is substantially higher (44% instead of 30%).

their portfolio the likelihood to grow remains largely unchanged – 31% instead of 34%. However, the likelihood to shrink is substantially higher (44% instead of 30%).

Adding or deleting brands reduces the odds of maintaining a stable market share, but not symmetrically. Selling more brands does not result in a more effective barrier to lose share, nor does decreasing the size of a portfolio imply that you have a more difficult time growing. What increases, however, are the odds to grow for manufacturers which increase portfolio size and the odds to shrink for those that decrease portfolio size.

Data:16,000 national brand manufacturers per year, top 30 manufacturers per country (incl. PLs), 10 countries, 6 years of data, up to 90 consistently defined categories