How successful are National Brands and Private Labels if their prices differ little vs a lot?

Economic theory would suggest that National Brands have a tougher time in categories where they are relatively more expensive than in categories where they are not – in reality, it is the opposite: National Brand shares are on average higher where they charge relatively higher premia, and they are also more resilient

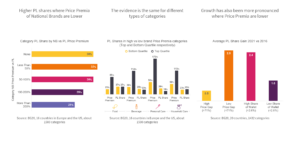

Higher PL shares where Price Premia of National Brands are Lower

More premium prices of National Brands relative to Private Labels are not furthering PL success. Categories where consumers are willing to pay high premia for NBs versus PLs (read: NBs have built strong equity) boast lower PL value shares. We cannot claim a causal effect but strong evidence that people are willing to pay more if what they get justifies the outlay.

The evidence is the same for different types of categories

The chart shows the top and bottom quartile of categories respectively in terms of the price distance between NBs and PLs. While the price distances (by design) differ dramatically, the success of PL shows interesting patterns. In Personal Care, for example, PL value share in the quartile of categories that boast the highest brand price premia (173% or more) is substantially lower (16% on average) than the average value share of 29% where brand price premia are low (below 59%).

Growth has also been more pronounced where Price Premia are lower

We know that tough times further PL growth (saving, but also reduction in marketing spend by NB manufacturers). However, where brands are relatively strong (i.e. they are able to charge higher premia) PL growth was substantially lower than where prices of NBs and PLs are more similar.

Watch out, however, if your category makes up a high percentage of households’ FMCG spend. In such categories PL growth was more pronounced: switching to PL provides a higher saving potential.