Categories and their ceiling

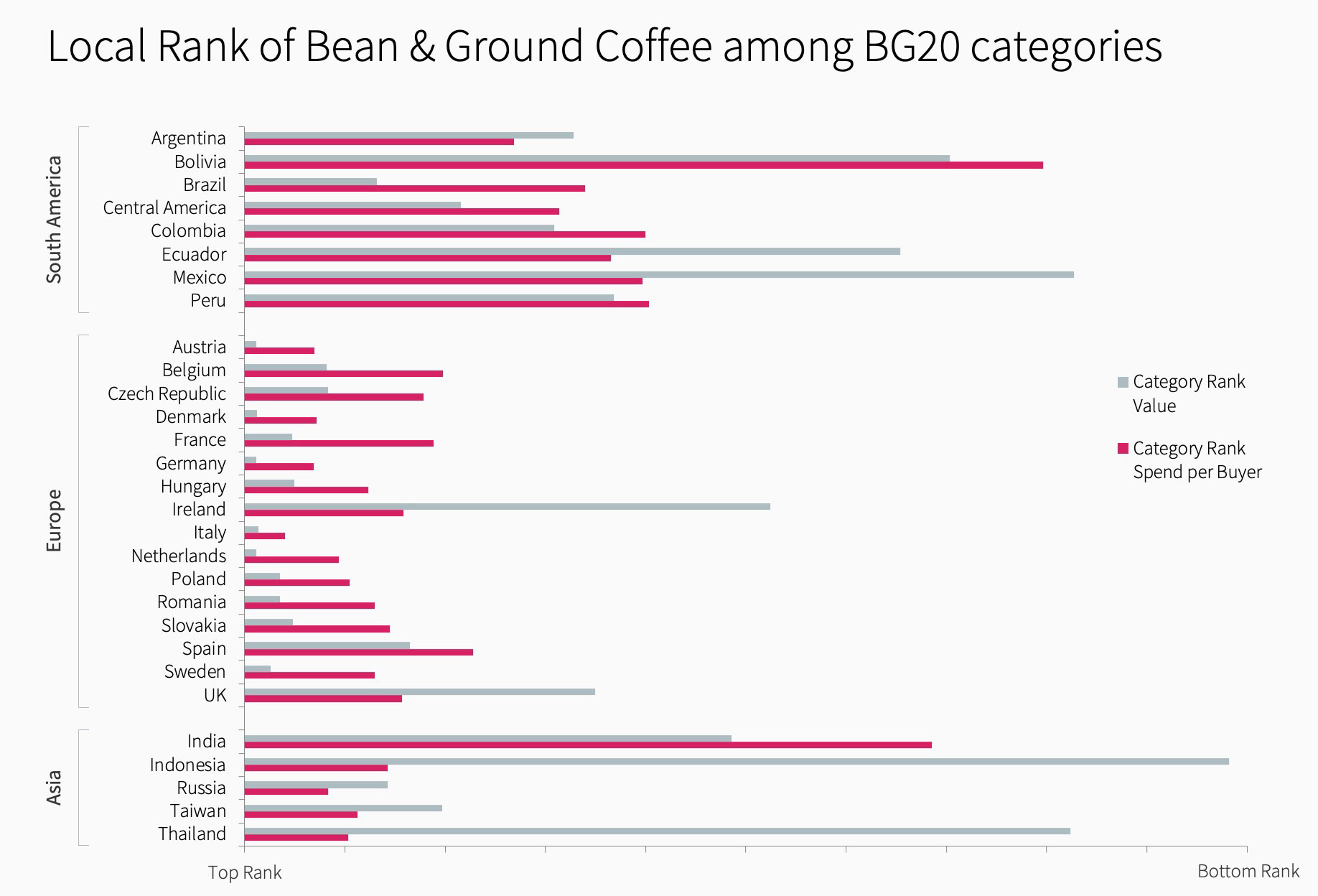

A category’s popularity in a country depends on history, cultural and consumption habits as well as marketing activities of brands and retailers. To understand the untapped potential of categories, we rank categories via two measures in each country: (1) the total category value and (2) spend per household buying the category. If a category is ranked higher on (2) than (1), then there are obvious growth opportunities by finding more buyers for the category. If a category is ranked higher on (1) than (2) the average household spends proportionately less and growth may result from premiumisation.

Let’s illustrate the logic using Ground coffee as an example: In Sweden, one of the top coffee consuming nations in the world*, coffee is the third most valuable category in the BG20 universe of categories, but is ranking 13th in spend per coffee-buying household. This is typical of many European markets where coffee is amongst the most valuable categories and even ranks number 1 in Austria, Germany, the Netherlands, Denmark, and Italy. The average household spend for coffee in these countries tends to rank somewhat lower. In contrast, many South American and Asian countries show the opposite pattern: bean and ground coffee total value ranks rather low compared to other categories, but much higher in terms of spend per household buying coffee.

Let’s illustrate the logic using Ground coffee as an example: In Sweden, one of the top coffee consuming nations in the world*, coffee is the third most valuable category in the BG20 universe of categories, but is ranking 13th in spend per coffee-buying household. This is typical of many European markets where coffee is amongst the most valuable categories and even ranks number 1 in Austria, Germany, the Netherlands, Denmark, and Italy. The average household spend for coffee in these countries tends to rank somewhat lower. In contrast, many South American and Asian countries show the opposite pattern: bean and ground coffee total value ranks rather low compared to other categories, but much higher in terms of spend per household buying coffee.

As a result, growth in Europe would more likely be from premiumisation as opposed to South America and Asia where increasing category penetration should be the focus for brands.

Comparing total category value and average buyer value provides a nuanced view of how to tap category potential. In case you were wondering whether certain categories do well on both measures: Beer and Spirits often rank high, and take spots 1&2 on both measures in the UK and Ireland. If you are interested in the local rank of any other category, please get in touch.

*BG20 and https://www.worldatlas.com/articles/top-10-coffee-consuming-nations.html