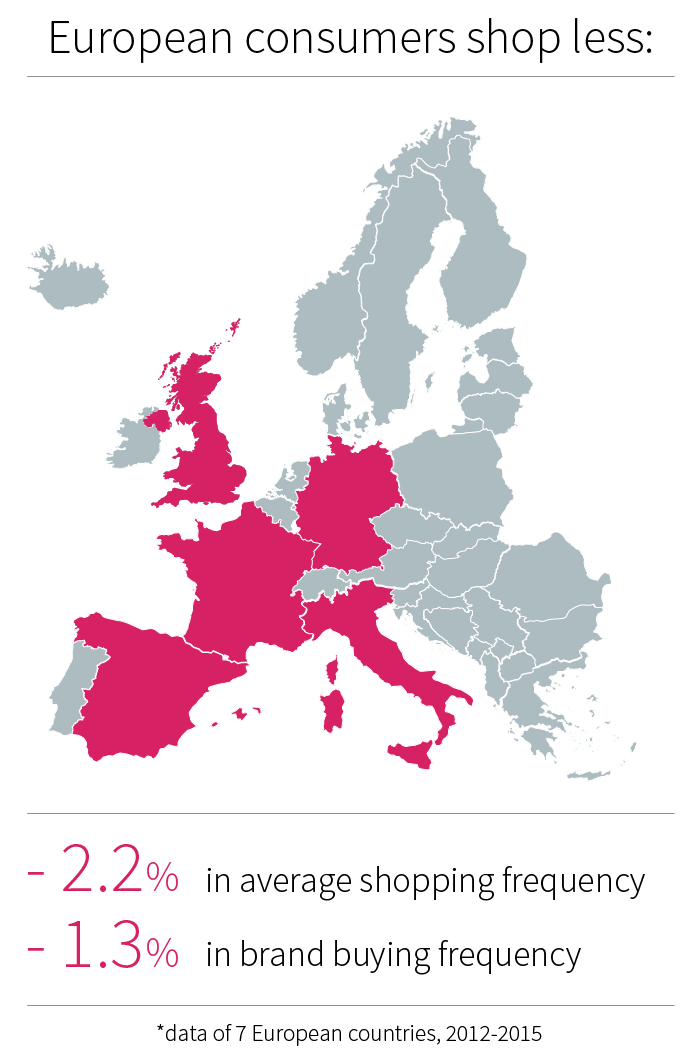

European consumers shop less: Do brands need to worry?

Across Europe* shoppers are visiting FMCG retailers less frequently, with the average number of visits per shopper

Across Europe* shoppers are visiting FMCG retailers less frequently, with the average number of visits per shopper

declining by 2.2%between 2012 and 2015. The resulting reduction in shoppers’ exposure to the retailers’ portfolios in turn impacts the average brand’s purchase frequency.

Frequency of purchase of the average brand has dropped by 1.3% – not quite as steep a decline in purchases as the average retailer has experienced in visits. However, the size of the effect on the number of times a brand is selected is determined by the overall frequency with which the category is purchased. The higher the category frequency the greater the % decline in average brand purchases.

- Categories which are bought on average over 10 times a year experienced a 1.8% reduction in purchases.

- Beverages and Pet Food both of which are high frequency categories, experienced drops in average brand frequency of 2% and 4% respectively.

- Other categories where shoppers have reduced brand purchasing frequency more than average are high frequency impulse categories such as Chocolate, Colas and Chips, where reduced exposure in retailers has somewhat curtailed the temptation to buy.

The size of the brand has also had an effect, as larger brands that are chosen more often have lost 2% of purchase frequency, while smaller brands have lost only 0.9%. This should be heartening to non-category leading brands who will be suffering less from the overall decline in store visits than their bigger rivals.

Brands, especially the ones hit hardest, need to find ways to compensate for the resulting sales loss. Potential actions include: package size changes to increase volume per occasion, more variety to increase number of units purchased, multi-pack promotions or price increases, which could all do the job, but will probably vary in effectiveness by brand.

* Study includes: Great Britain, Spain, France, Italy, Germany, Belgium, Netherlands