Another week with a renewed focus on Private Label (PL) Growth in Europe (the most developed region in terms of PL offerings).

Is total category expenditure linked to PL success? How is PL success related to the price premium of brands vs PL? Is growth more or less likely when PL is already strong?

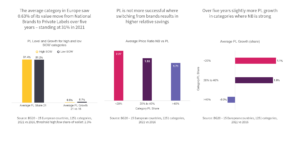

The average category in Europe saw 0.63% of its value move from National Brands to Private Labels over five years – standing at 31% in 2021

How much of their budget consumers allocate to a category hardly matters for PL success: Both high and low share-of-wallet (SOW) categories boast an average PL share of around 31% and a growth over 5 years of roughly half a percentage point.

PL is not more successful where switching from brands results in higher relative savings

The price premium charged by National Brands versus Private Labels is higher in categories where PL commands less share. Where people perceive a reason for paying more, they are willing to stick with National Brands. Investing in brand equity (through innovation, advertising, distinctive packaging) pays off.

Over five years slightly more PL growth in categories where NB is strong

While PL growth overall was modest between 2016 and 2021, the highest growth happened in categories where PL started out weak. More room to grow and potentially more efforts by retailers to get a foothold. An encouraging sign for brand manufacturers that winning back share is possible even in high PL categories.