How does shopper purchase frequency of brands stack up against their purchase frequency of categories?

And how much does frequency differ between brands that vary in terms of penetration?

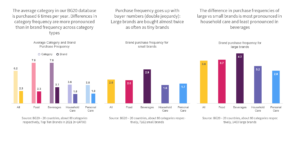

The average category in our BG20 database is purchased 6 times per year. Differences in category frequency are more pronounced than in brand frequency across category types

Across the 1500 categories we track in BG20 food and beverage categories are bought almost twice as often as household and personal care categories. Brand purchase frequencies vary less (highest with 3.1 in beverage vs lowest with 1.8 in HH care).

Purchase frequency goes up with buyer numbers (double jeopardy): Large brands are bought almost twice as often as tiny brands

Brands which reach few category buyers (less than 5%) are purchased by their shoppers about twice a year – more often in beverage categories – an indication of higher loyalty enjoyed by regionally strong brands (dairy, beer, soft drinks).

The difference in purchase frequencies of large vs small brands is most pronounced in household care and least pronounced in beverages

Brands which reach many category buyers (more than 30%) are purchased by their shoppers almost 4 times a year – with personal care categories showing relatively lower frequencies.