How many new products in FMCG?

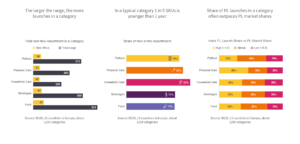

The larger the range, the more launches in a category

The new product activity in a category increases with the existing assortment size in that category (correlation =0.86): Categories with large assortments (typical for categories with many buyers and high frequency) see more new products being launched than categories with small assortments. In the average category, a very involved shopper would find 66 SKUs which are younger than a year.

In a typical category 1 in 5 SKUs is younger than 1 year

When comparing the percentage of the assortment that is younger than one year, different category types do not vary much. Interestingly, the share of new products is highest in Household Care categories which on average have smaller assortments, and lowest in Food categories which on average have larger assortments. Detergents, fabric and hair conditioners or nappies feature as the categories with the highest assortment share of new products.

Share of PL launches in a category often outpaces PL market shares

Is PL pulling its weight in a category’s new product activity? We create a category index dividing the share of launches which come from PL by the market share commanded by PL. In about 26% of all categories this index is below 0.8, while in about 36% of categories it is above 1.2. PL is relatively most active in Personal Care (where its actual market share is lowest). Keep in mind that by definition each PL launch will only be available in one retailer whereas each NB launch can expect to be listed in multiple retailers.