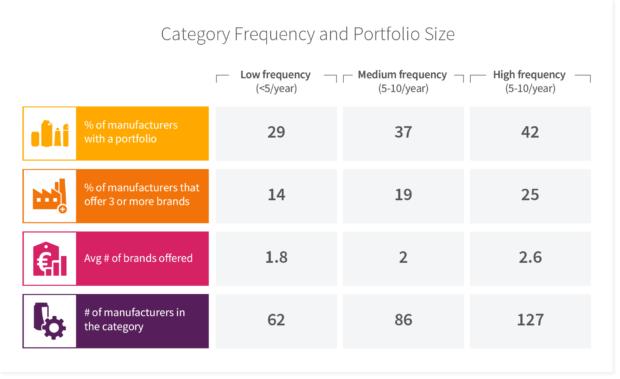

Category Frequency and Portfolio Size

As shown in past blog entries, category purchase frequency affects, for example, loyalty, shoppers lost and gained from one period to the next or the number of different SKUs which are available. Today we look at one important strategic branding decision: the number of brands a manufacturer offers. We distinguish between three types of categories: less than 5 occasions per year, 5-10 occasions per year and more than 10 occasions per year.

- In categories with low purchase frequency, comparably few manufacturers offer more than one brand.

- In categories with high purchase frequency, more manufacturers offer large portfolios.

- Categories where one-brand manufacturers dominate, are infrequently purchased categories like window cleaners, dishwasher products or canned green beans – but also frequently purchased categories where people may not be interested in or even avoid variety (e.g. nappies or razor blades).

- Categories where multi-brand manufacturers dominate are frequently purchased categories like spirits, ice cream or biscuits, but also categories where we find large heterogeneity in consumer expectations which cannot be served by one brand only (e.g. deodorants) or a high desire for variety (e.g. beer).

Category purchase frequency does shape the brand portfolio decisions of manufacturers, but the relationship is more nuanced. If a category results in shoppers’ seeking or avoiding variety or if one brand is not sufficient to appeal to a sufficiently large part of the market, brand portfolio sizes can deviate from what category purchase frequency would predict.