Top brands do better in Asia and South America than in Europe or the US

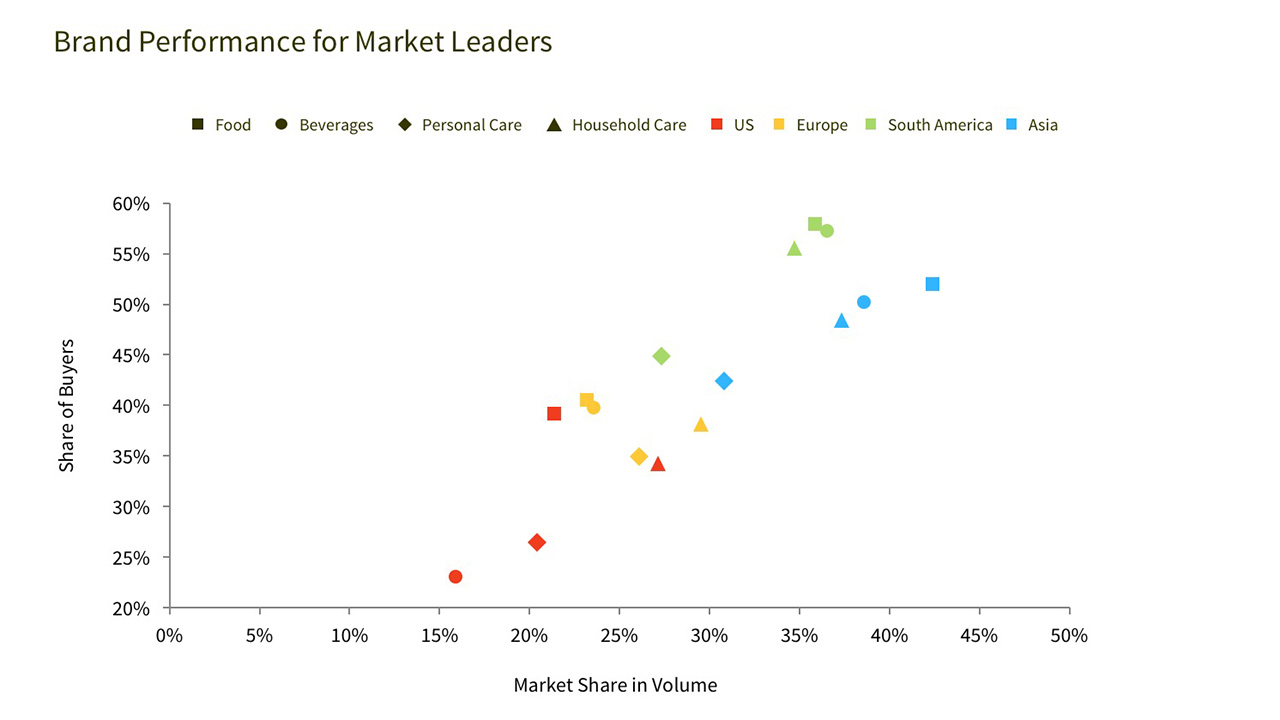

Two of the most widely used (and highly correlated) measures for a brand’s strength are market share and relative penetration (the percentage of category buyers that buy the brand). We examine these two indicators for number one brands in four regions (Europe, US, Asia and Latin America) across about 80 categories and identify four regional clusters.

- Latin America is a region where the typical number one

brand enjoys comparably high market share and reach, especially in food and beverage. Relatively strong number one brands are likely a consequence of lower private label shares and possibly less intense direct competition.

brand enjoys comparably high market share and reach, especially in food and beverage. Relatively strong number one brands are likely a consequence of lower private label shares and possibly less intense direct competition. - The average number one brand in Asia commands rather high market shares compared to other regions, but reaches fewer shoppers than its peers in Latin America. This difference can be attributed to lower shopping frequencies in Asia versus Latin America which, everything else equal, leads to smaller brand repertoires for the average household, and fewer buyers for comparable market shares.

- Number one brands in Europe have lower reach and market share compared to regions like Asia and South America, but still perform better than number one brands in the US, where especially beverage and personal care brands lag behind. For both, Europe and the US, a larger assortment of national brands (which induces switching) and a substantially stronger PL position make for a tough competitive environment.

These results are a reflection of economic and modern trade developments in different geographic regions and should help brands, especially the ones competing globally, to set realistic expectations: Brands are still likely to attain higher performance with respect to both share of buyers and market share in developing markets. But they also need to continue long-term investment to safeguard future expectations as private labels are much more likely to be successful where brands have failed to invest.