Big 3 on the rise

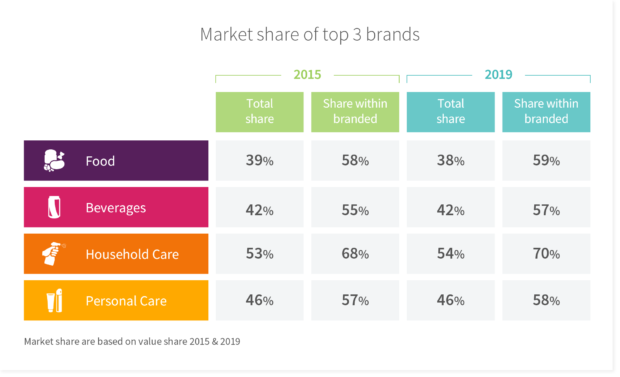

Because consumers are supposed to be seeking out smaller (e.g. local, sustainable, niche) brands and also because private labels are still growing one would expect tough times for the big players in a category. However, market shares of leading brands were very stable between 2015 and 2019 and have even increased when taking into account brands only:

- On average, the branded market share taken by the top 3 national

brands has experienced a small uplift from 59% in 2015 to 60% in 2019. In comparison, the average PL share has grown by 1.3% in these 5 years.

brands has experienced a small uplift from 59% in 2015 to 60% in 2019. In comparison, the average PL share has grown by 1.3% in these 5 years. - Household Care is the most attractive category type for big brands with a branded market share of 70% in 2019, compared to Food where the top 3 only command 59%.

- Countries in which big brands showed an increase in branded share include Russia (+2%) and Italy, Poland (+1% each). Markets where the 3 big players experienced a drop were Spain (-3%), Austria and Poland (-1% each).

- The UK (69%) and Austria (67%) are the countries where the top 3 players on average take the largest share of the branded market in 2019. In contrast, the top 3 share is only 37% in Italy and 46% in Russia.

The advertised demise of large brands seems to be a myth. On average they have stood their ground and even won some share from their branded peers. Note, however, that these averages do hide quite some variation in the share of large brands and also in top 3 membership over time.