Who are the category leaders?

Changing our usual perspective, this article focuses on the largest manufacturers in 839 categories across 10 countries in 2019. We also treat a specific retailer’s private label (PL) range as if it is produced by one manufacturer only (which often is not the case).

Changing our usual perspective, this article focuses on the largest manufacturers in 839 categories across 10 countries in 2019. We also treat a specific retailer’s private label (PL) range as if it is produced by one manufacturer only (which often is not the case).

Our analysis shows that a PL is the largest player in 20% of all categories (up from 17% 5 years earlier). This varies between category types: While PLs rarely dominate personal care categories (1 in 9 leaders is a PL), food categories feature a PL at the top in almost 1 out of 3 instances. Food and beverages are also the category types where national brand (NB) manufacturers have most often lost the top spot to a PL over the past five years.

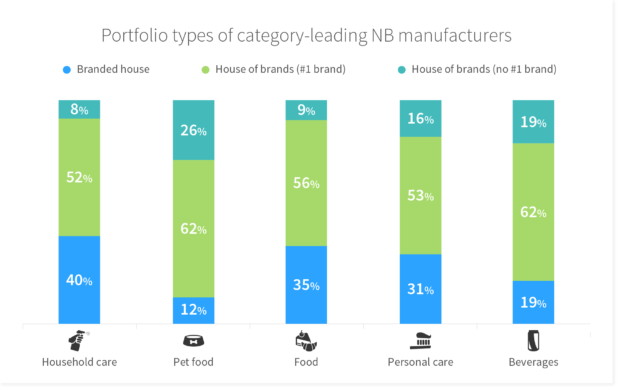

Amongst category-leading National Brand (NB) manufacturers (666 cases), we distinguish between three types of portfolios:

- the manufacturer sells one brand only (a strategy called “branded house”)

- the manufacturer sells multiple brands (a “house of brands”), one of which is the largest brand in the category, or

- a house of brands that does not feature the largest brand (i.e. this manufacturer’s brands jointly command a higher share than the leading brand in the market).

30% of NB category leaders adopt the branded house strategy, whereas 70% of all category leaders compete with a house of brands. 1 in 5 of the latter cases is a portfolio that does not contain the largest brand in the category in the country. This distribution varies across category types (see Figure). For example, branded houses rarely lead the category in beverage or pet food, whereas a house of brands without the #1 brand is much less common in food or household than in petfood or beverages.

We will share the most effective portfolio strategies of category leaders in more detail throughout our next newsletters and in our yearly BG20 summit taking place on October 20th, 2021.