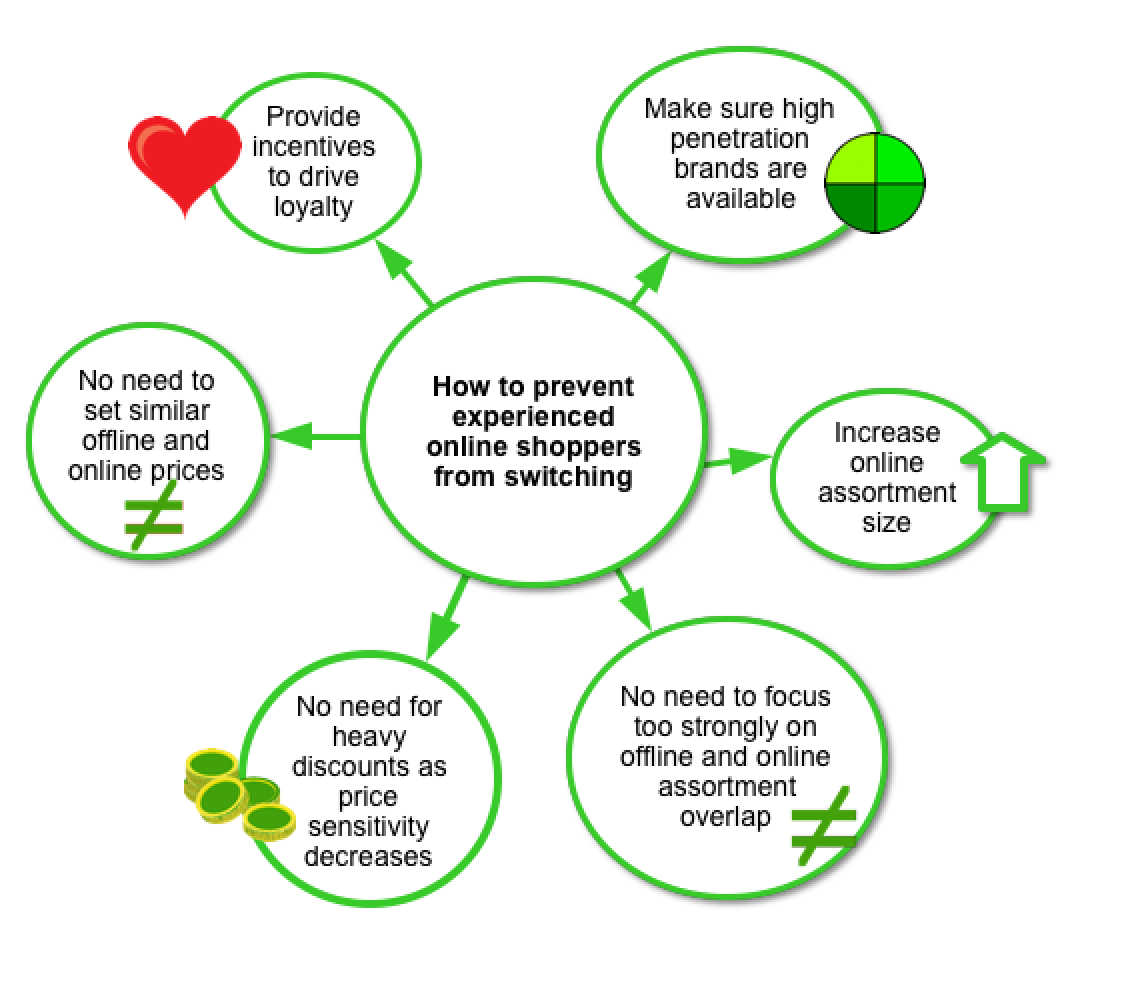

Experienced multi-channel buyers start cheating

A recent study amongst UK households shows that retailer loyalty of multi-channel shoppers decreases the more experienced they are as shoppers. Initially, shoppers tend to be risk-averse and choose the online store belonging to their preferred grocery chain, especially if the retailer’s offline and online assortment is strongly aligned.

A recent study amongst UK households shows that retailer loyalty of multi-channel shoppers decreases the more experienced they are as shoppers. Initially, shoppers tend to be risk-averse and choose the online store belonging to their preferred grocery chain, especially if the retailer’s offline and online assortment is strongly aligned.

When consumers get more confident with the online environment, they start purchasing online from competitors. Securing consumer loyalty requires wise management of the online assortment: a 10% increase in the number of brands increases the online store’s choice probability by 30%. Also by providing high penetration brands retailers can retain their loyal offline shoppers in their own online channel.

Source: Melis, Campo, Breugelmans & Lamey (2015).The Impact of the Multi-Channel Retail Mix on Online Store Choice: Does Experience Matter? Journal of Retailing, forthcoming.