Brand loyalty: what’s the impact of size and price?

Last week’s blog focused on shopping frequency and its impact on loyalty – this week we examine the impact of the brand’s share and its price

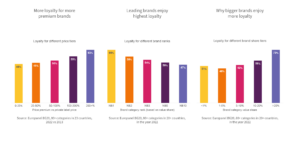

More loyalty for more premium brands

High prices may be a curse in disguise: while they signal equity (based on quality, heritage or some other reputational factor), they could also serve as a constant reminder that other options in the category are more affordable. Amongst buyers of relative expensive brands high prices seem to pay off in terms of loyalty: these brands command a larger share-of-wallet amongst their buyers (part of which is a result of the higher price they pay) indicating that these brands are more than an occasional treat.

Leading brands enjoy highest loyalty

As we have often shown, #1 brands usually are leading the category because they have more buyers that buy them more often. What about loyalty? Buyers of #1 brands on average allocate two thirds of their category spend to these brands – compared to only 50% (45%) for the #3 (#10) brand in the category. Apart from the higher availability of leading brands (which facilitates rebuying) infrequent category buyers also tend to choose the leading brands. These buyers, because of their low frequency, boast higher share-of-wallets for the brand(s) they buy because their repertoire size is lower.

Why bigger brands enjoy more loyalty

Based on the previous entry, it will come as no surprise that the market share that a brand commands impacts its loyalty level. Because large repertoire sizes (i.e. buying lots of different, especially smaller, less available brands) coincide with frequent category buying, smaller brands typically share their buyers’ category spend with more other brands. Hence they must expect their loyalty levels to lag behind the levels larger peers enjoy: small brands (less than 5% share) – the vast majority of brands in FMCG – reach almost 50% loyalty, while the few category dominators (with more than 20% share) surpass loyalty levels of 70%.