Shopping frequency among new, lost and retained category buyers

Following up last week’s analyses focusing on brand purchase frequency this week’s pick investigates the category angle

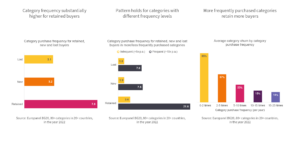

Category frequency substantially higher for retained buyers

Shoppers who return to a category in the following year shop for the category about 2.5 times more often than shoppers who have not purchased in the last year or who have been lost (for that year). Put more simply: infrequent buyers of a category are much more likely to go a full calendar year without a purchase than are frequent category buyers.

Pattern holds for categories with different frequency levels

Irrespective of how often a category is purchased by the average shopper, those shoppers who buy in subsequent years buy it at least twice more often than shoppers who start or cease buying the category. Again, like last week, we see that in 2022 (with few lockdowns) new buyers buy more often than the lost buyers of 2022 did in 2021. The ratio between retained and new/lost for frequently purchased categories is higher than 2.5 because some of them are more likely to feature extremely heavy buyers compared to infrequently purchased categories.

More frequently purchased categories retain more buyers

Retaining buyers (both for categories and brands) is much easier for more frequently purchased categories. Most brands and categories in durables will face massive churn (because most households do not buy a car or a TV each year), but the same is true for FMCG: lower purchase frequencies result in more households missing a purchase in any given year. The relationship is far from perfect, however. The correlation between frequency and churn is -0.48 and the variation in lost buyers is substantial: for example, of all categories with an average frequency between 8 and 10 purchases per year (n=108) one quarter loses more than 18% while one quarter loses less than 10% of their shoppers respectively. Make sure you understand the stickiness of your category.