This week we update the grocery market trends in Ukraine. Our GfK colleagues there continue to resist and maintain operations in agreement with panel members.

We can now share the latest trends up to the end of 2022. Our best wishes continue to go out to our team, our panellists, their families and everyone there.

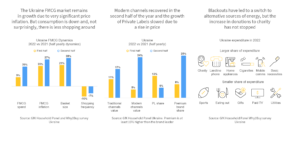

The Ukraine FMCG market remains in growth due to very significant price inflation. But consumption is down and, not surprisingly, there is less shopping around

1 in 2 Ukrainians is struggling financially and cannot cope with the inflation caused by the cost of logistics. The majority of buyers (2/3) say that they are changing their buying behaviour. The main coping strategy is buying less but still trying to follow pre-war consumption habits. As a result, consumption continues to decline.

Modern channels recovered in the second half of the year and the growth of Private Labels slowed due to a rise in price

In the 2nd half of the year, modern formats rebuilt destroyed warehouses and logistics to cope better with blackouts. The sharp increase in Private Label price compared to brands slowed its growth. But Premium continues to grow especially in confectionery, hot beverages, personal care and basic categories. Switching between brands is generally forced by supply and availability.

Blackouts have led to a switch to alternative sources of energy but the increase in donations to charity has not stopped

The problems with electricity and heating due to the destruction of infrastructure led to an increase in expenditures for generators/charging stations and a return to a landline phone, but also “savings” on utility bills and other leisure activities. Charity donations doubled in comparison with the pre-war period.