Winners up their pack sizes

This blog aims to add more nuance to our understanding of pack size changes. We investigate how pack size changes are linked to a product’s price level (cheap vs. premium) and to market share changes (winners vs. losers).

Market share winners between 2012 and 2016 have increased their average pack size offered by 1%. This increase in pack size is more pronounced for share winners in Asia (+ 3%) and the US (+2%). Particularly in petfood, share winners put more content into their average pack size on offer (+5%).

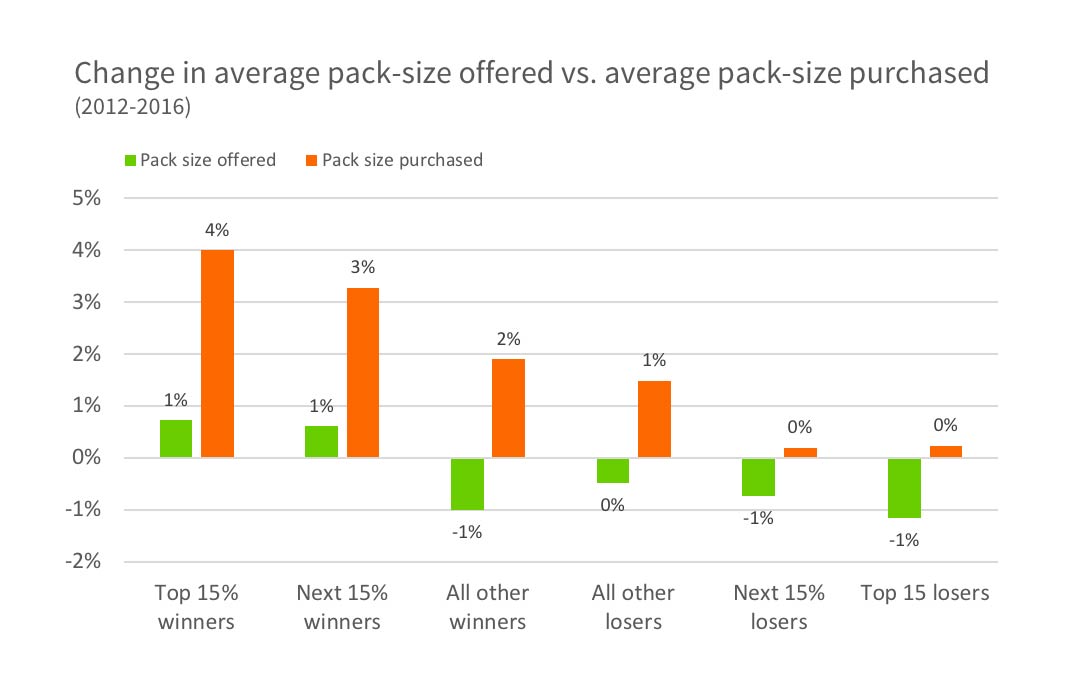

Market share winners between 2012 and 2016 have increased their average pack size offered by 1%. This increase in pack size is more pronounced for share winners in Asia (+ 3%) and the US (+2%). Particularly in petfood, share winners put more content into their average pack size on offer (+5%).- When it comes to sizes chosen for share winners, shoppers prefer larger packs: The average pack size purchased of the top 15% share winners has increased by 4% while the top 15% share losers on average offer similar pack sizes in 2012 and 2016. Again, Asian consumers and consumers with pets are particularly likely to choose larger packs from share winners.

- Brands with premium-priced products (price at least 1.75 times the category price) have decreased their average pack size (-1%). This trend is more pronounced for premium products in beverage (-2%), food (-2%) and household care (-3%). Cheap brands (price below the category price) have kept their average pack size unchanged.

- Shopper choice regarding pack sizes for premium brands does not follow their downsizing strategy – the average size chosen remained unchanged. For the average cheap brand the chose size has increased (+2%).

Our analysis shows that reducing pack-size does not pay off in terms of market share gains and shopping behaviour. Market share winners are more likely brands that maintain or increase pack size – which consumers seem to interpret as better value. Note that we only focus on the average pack size offered and chosen – the analysis is not arguing that adding additional pack sizes that are smaller never makes sense.

*Analysis includes 25 countries, 86 categories and 13,991 products.