Private Label performance over five years

The contribution of high vs low PL share categories

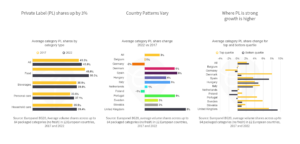

Private Label (PL) shares up by 3%

Over the past five years, PL shares in the average category across Europe have increased by 3%. Currently, 56% of the volume sold in these categories is attributed to brand manufacturers.

- Food: PL has shown significant strength in food categories, now holding just over 50% market share, with an increase of 3.5% over the last five years.

- Personal care: although PL in personal care has also grown by 3.5%, it remains less dominant, capturing over one-third of the volume sold.

- Beverages: branded shares in the beverage sector have remained relatively stable, experiencing a minimal decline of just 0.6% in the average category.

Country Patterns Vary

In almost all countries PL gained share in the average category between 2017 and 2022 (note: this is an arithmetic average across categories which will differ from a country‘s total PL share trajectory). Average category growth was most pronounced in the UK, Spain and Portugal, whereas national brands in Germany and Poland did manage to gain back some share in the average category.

Where PL is strong growth is higher

In a majority of countries (8 out of 12), the growth in strong PL categories (comparing the 25th and 75th percentile of PL share) outpaces the growth in weak PL categories. What does this mean? Ignore PL growth at your own risk: once PL captures a substantial market share (with the top quartile exceeding 50% in almost all markets), it becomes increasingly challenging to convince consumers to remain loyal to national brands or switch back from PL products.