Discount shopping – a real threat to FMCG growth?

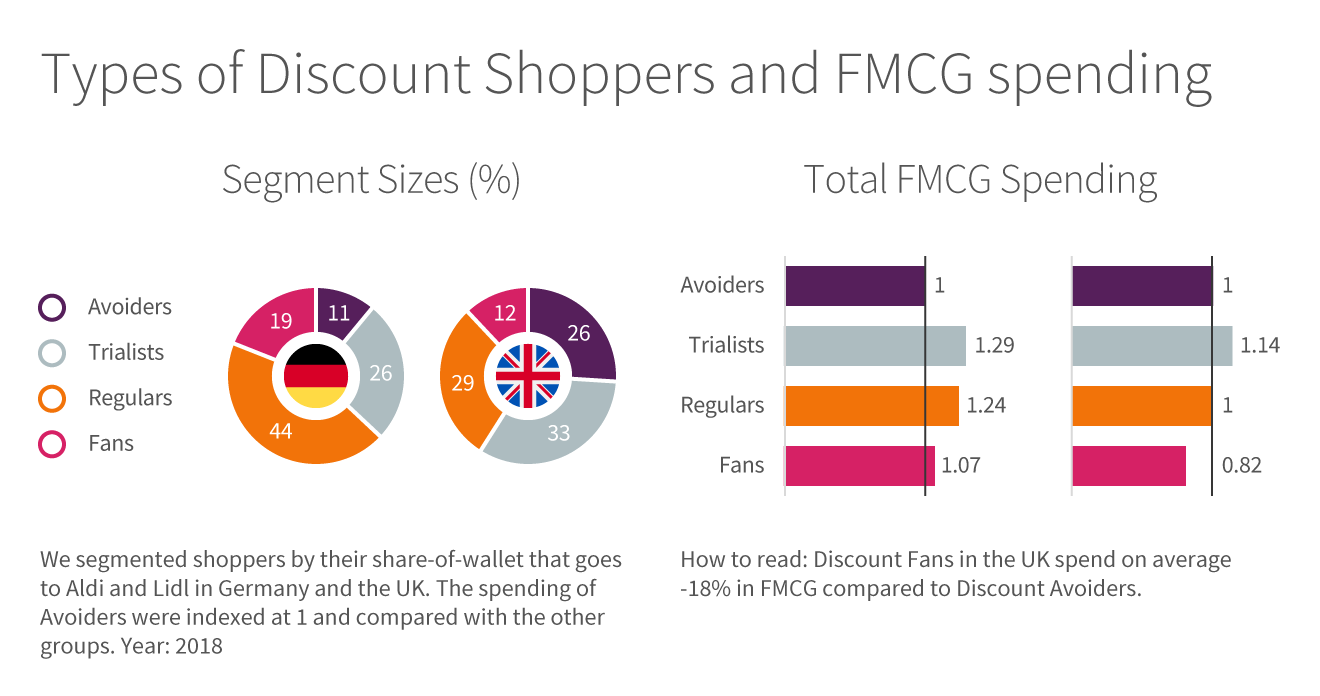

Some shoppers love the simplicity of discount formats, others avoid the format and prefer supermarkets or hypermarkets with broader and deeper assortments. Most split their trips between different formats, often strategically choosing a format depending on that day’s shopping mission or locality. We investigated how these groups differ for various shopping characteristics and created four discount shopper segments in Germany and the UK based on the share-of-wallet a household allocates to the hard discount channel:

Avoiders (0% of their FMCG spend at discounters)

Trialists (1-10% at discounters)

Regulars (11-50% at discounters)

Fans (more than 50%)

Some noteworthy findings across these four groups (see figure):

- In Germany there are substantially more Fans (19%) and Regulars (44%) due to the long tradition of discounters in this market. The UK has fewer Fans and 2.5 times more Avoiders than Germany.

- Avoiders and Fans spend less on FMCG than Trialists and Regulars with Trialists spending most.

- As the share-of-wallet going to discounters increases, the overall FMCG spend decreases. The drop is particularly pronounced in the UK, where Fans’ total FMCG spend is 30% lower than Trialist’s spend.

With the continuing growth rate of discounters in many European markets (the UK is not the only country where the channel boasts impressive growth rates) these patterns are not necessarily good news for the FMCG industry. As the percentage of people qualifying as Fans goes up, the industry will experience a drop in value. It is unlikely that a decline in the number of Avoiders (who also do not spend a lot) will compensate for this.