Inflation and prices paid – what happens, when and how to manage

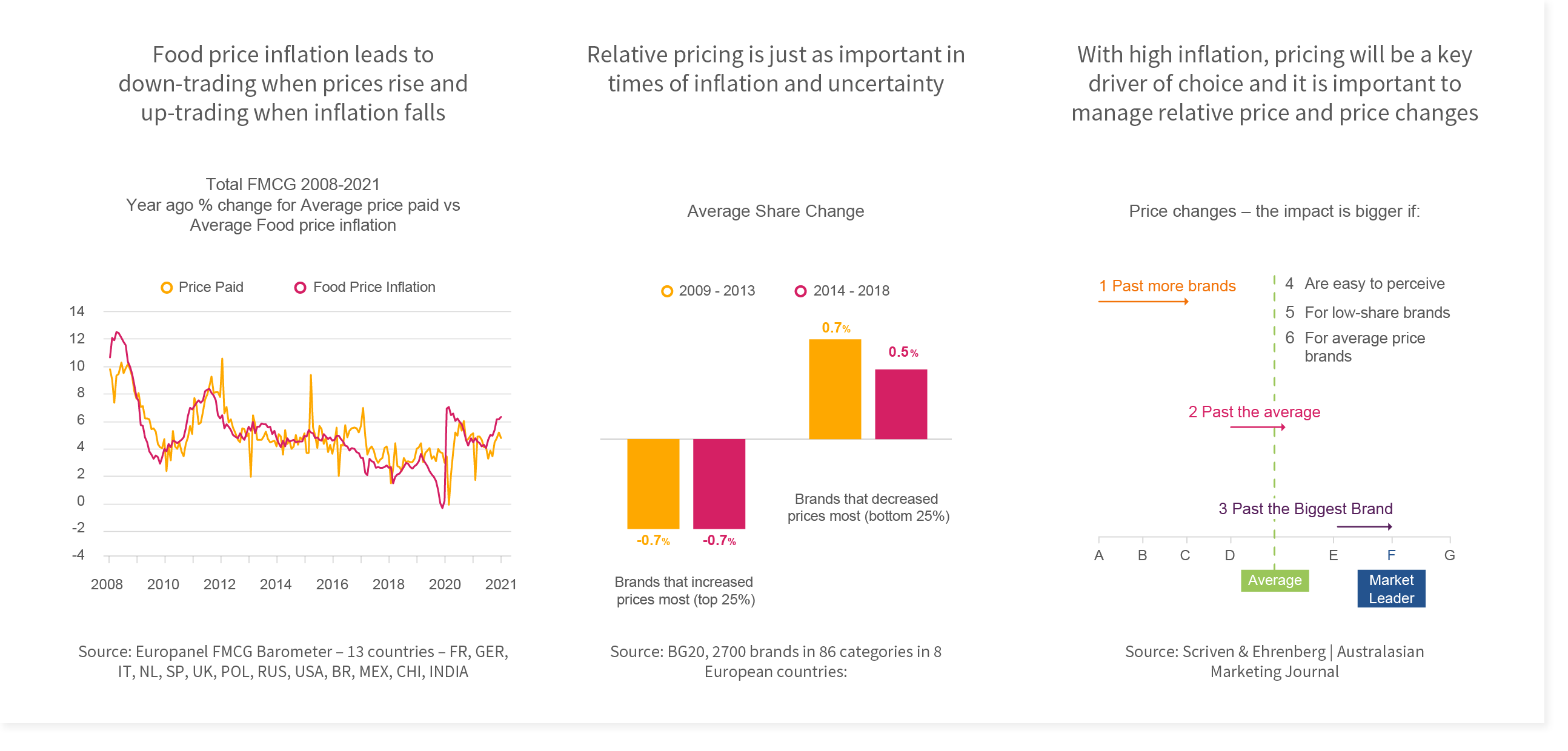

Food price inflation leads to down-trading when prices rise and up-trading when inflation falls

As prices rise, shoppers look to contain their spend and down-trade. When inflation falls, they are less concerned and up-trade. This behaviour delays the impact of inflation on the market by about 12 weeks and can help predict when down-trading and up-trading will likely occur.

Relative pricing is just as important in times of inflation and uncertainty

Brands with the highest price increase suffered similar share losses during the economic downturn (2008-13) and in the subsequent 5 years. Brands that lowered price gained more during the financial crisis when there was down-trading and less when there was general up-trading. Predicting periods of down/up-trading can help pricing tactics.

With high inflation, pricing will be a key driver of choice and it is important to manage relative price and price changes

Understanding when we are likely to see more down/up-trading will help pricing tactics but competitive pricing awareness remains critical. Consumers have a ‘reference price’ in mind for a brand and changing the pricing relationship vs. other brands can undermine this perception.