Components of Retailer Category Share

Reach matters more than frequency and spend per occasion

Over the past several years we have frequently shown the well-established relationship between a brand’s share and its reach. With this blog we initiate a more retailer-centric set of blogs and start by investigating the role of different components of a retailer’s category market share.

Over the past several years we have frequently shown the well-established relationship between a brand’s share and its reach. With this blog we initiate a more retailer-centric set of blogs and start by investigating the role of different components of a retailer’s category market share.

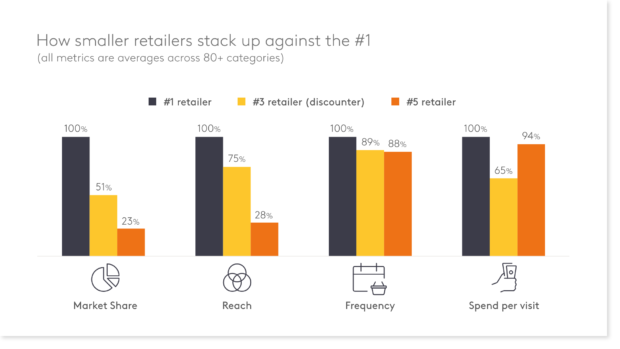

We use the Dutch FMCG market as an example and pick the number 1, number 3, and number 5 retailer (in terms of market share). Their average category shares (across 84 categories from our BG20 initiative) are nicely distributed with number 1, a supermarket chain (24.5% share in 2021) capturing about twice the share of number 3, a discounter (12.6% share) the share of which again is about double the share of number 5, a supermarket chain (5.6%).

How do these relationships compare with the average category’s number of buyers, their frequency of shopping for this category and the amount spent per occasion at each retailer?

For the average category, retailer #5 shoppers visit the retailer 12% less often than do shoppers of retailer #1 and they spend 6% less per trip. Retailer #3 faces a similarly small disadvantage in frequency (11%), but a much larger gap in spend per occasion (35%) – but keep in mind, this is a discounter. The main driver of the difference in market shares is reach: For the average category, retailer #3 (#5) attracts 25% (72%) fewer shoppers than retailer #1. The same applies for all other retailers not shown in this analysis.

A retailer that aims to increase its category market share therefore needs to focus on attracting more buyers to buy that category – the existing ones already visit (almost) as often and spend (almost) as much as shoppers in the leading retailer.

If you have any comments please contact oliver.koll@europanel.com