Do dinosaur brands face extinction?

Big brands cannot grow their shares infinitely. Besides the obvious limit (there are only a 100 share points to distribute), new brands (and Private Label) enter the market, consumers’ tastes change and no single brand can credibly cover all shopper needs and price points. At the same time, big brands can leverage their clout to get better access to shelves for their new products and can command higher share-of-voice. So how have they fared over the past ten years? We examine the volume share of the top 3 brands in 79 categories in 9 countries from 2009 to 2017.

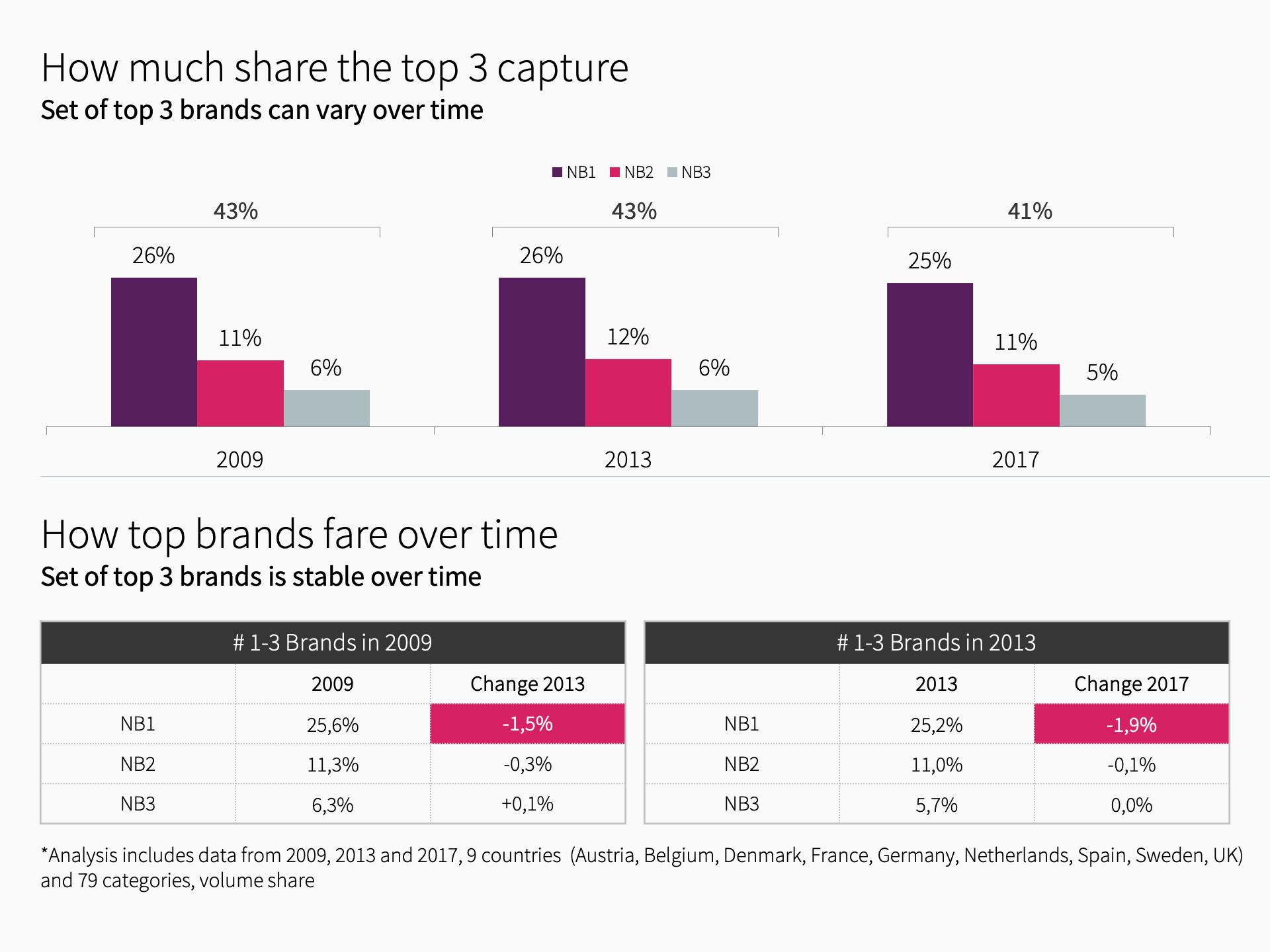

- Aggregate Top 3 shares have remained quite stable

In 2009, the top 3 brands command, on average, 43% of the category total volume. The average number 1 brand snags more than half of this cake. 4 years later, the numbers have not changed, but from 2013 to 2017, we see the top 3 brands experience a drop down to 41%. - When on top, it is a tough climb

The three top brands in 2009 have lost 1.7% share until 2013. A similar pattern emerges for the top 3 brands in 2013 who lose 2% until 2017. Each time, the vast majority of this loss comes from the number 1 brand. However, this is not a general rule, but a tendency: 40% of top three brands have gained share.

The results suggest that fear of extinction may be premature, but we do find a limit for growth amongst leading brands. Some questions to follow up: Do we find the same pattern in developing markets? Why do # 1 players suffer more than #2 and #3 brands? Which brands actually benefit from the market share drop of the big players? For example, from 2013 to 2017 the non-top three brands (i.e. NB4 to NB10 in a category, hence not PL nor smaller brands) gained exactly the share lost by the top 3.