A final spotlight on changes experienced in FMCG markets during COVID, more precisely between 2019 and 2022.

Today we focus on the price gap between National Brands and Private Labels.

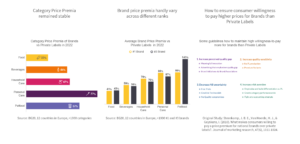

Category Price Premia remained stable

In the average category National Brand prices in 2019 were 61% higher than the price of Private Labels. Until 2022 that premium did not change. The highest price gap exists in Personal Care where Brand prices in 2022 are 77% higher than Private Label prices in the average category (76% in 2019). The lowest price gap exists in Food where Brand prices in 2022 are only 23% higher than Private Label prices in the average category (26% in 2019).

Brand price premia hardly vary across different ranks

The average #1 brand in a category charges about the same price as the average #2 or #3 brand. Also, these relatively large brands are on average a little more expensive than the other brands in the category.

Investing in brand equity pays off: More people buy the brand (larger penetration and therefore share) and they are also willing to accept higher Premia. Note that this average hides a lot of variation and not all top 3 brands are more expensive than the category brand price average.

How to ensure consumer willingness to pay higher prices for Brands than Private Labels

A large-scale study across countries across the globe and dozens of categories uncovered a number of activities that brands are advised to implement to maintain consumers’ willingness-to-pay more for Brands than Private Labels. All of these activities have two main thrusts: enhance the trust of shoppers when choosing National Brands and make them uncertain in their choice of Private Labels.