Brands must expect a certain number of their buyers in a given period to not buy the brand in the following period. Typically these lost buyers tend to be replaced by buyers that did not buy the brand in the previous period.

This Pick of The Week looks at the number of buyers that stop buying a brand or the category from one year to the next.

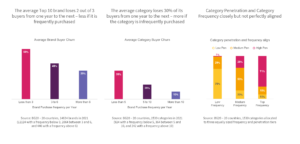

The average Top 10 Brand loses 2 out of 3 buyers from one year to the next – less if it is frequently purchased

Purchase frequency is closely linked to buyer churn: Brands that are purchased more than six times in a year will lose about 4 out of 10 buyers, while brands that are purchased less than three times lose 7 out of 10 buyers.

The average category loses 30% of its buyers from one year to the next – more if the category is infrequently purchased

Purchase frequency is closely linked to category buyer churn: Categories that are purchased less than five times in a year will lose about 4 out of 10 buyers, while categories that are purchased more than ten times lose only 1 out of 10 buyers.

Category Penetration and Category Frequency closely but not perfectly aligned

Frequently purchased categories also reach a larger part of the population (correlation between reach and frequency is 0.55): Only 1% of the low frequency tier categories features in the top penetration tier, and only 10% of the high frequency tier belongs to the bottom penetration tier.