How Brands are Bought: An Update of Purchasing Patterns in FMCG

Over the next few weeks we will look at a number of “established concepts” in consumer buying, starting today with the leaky bucket: how many of its buyers can a brand expect to lose from one year to the next?

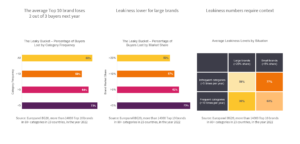

The average Top 10 brand loses 2 out of 3 buyers

For the average brand 2 out of 3 buyers in year t will not buy the brand in year t+1. A similar share of buyers will not have bought the brand in the previous year. Obviously, the terms “new” and “lost” adopt a year-to-year perspective as new buyers may have bought the brand in years before the last and lost buyers may well return again in subsequent years. In less frequently purchased categories leakiness is considerably higher than in frequently purchased ones.

Leakiness lower for large brands

Because larger brands’ buyers on average buy them slightly more often than smaller brands’ buyers (the discovery of this phenomenon, Double Jeopardy, in brand buying is attributed to Andrew Ehrenberg) they also lose (and gain) a smaller percentage of their buyers from one year to the next. Brands with a market share of more than 20% lose about half of their buyers, whereas brands with less than 5% share must expect 3 out of 4 to not return next year.

Leakiness numbers require context

Not surprisingly given the previous two entries, small brands in infrequently purchased categories retain a much smaller percentage of buyers than large brands in frequently purchased categories. This is simple maths: If your category is purchased often and your brand is among the most frequently purchased ones then the odds of losing buyers are much smaller than for the opposite scenario. Large brands in frequent categories lose just over 1 in 3 buyers whereas small brands in infrequent categories lose almost 4 out of 5 buyers.