During a recession winning brands innovate much more than losers

Over the last couple of weeks, as well as the latest FMCG trends pre and post lockdown, we have been looking at winning and losing brands over the 2008/2009 recession – that winning brands innovate much more than losers and that the probability of continued share growth or decline is around 75%.

We know that loyalty drops in times of uncertainty and that Private Label tends to grow – so how do these relate to the winning and losing brands in the last recession?

In addition to these questions, we continue to follow the latest FMCG trends.

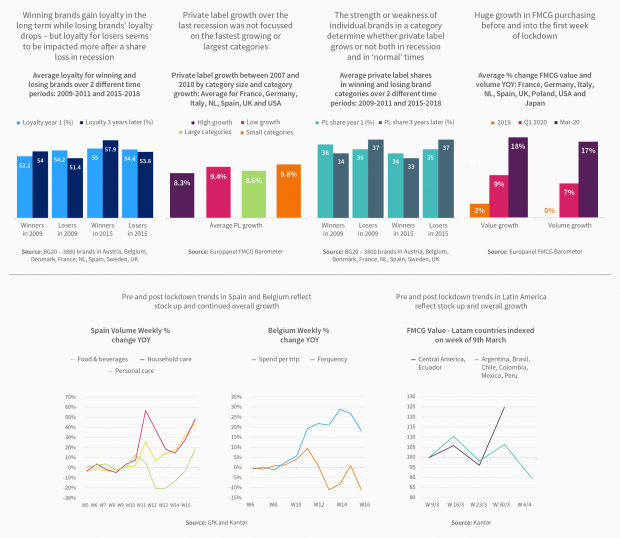

- Looking at loyalty across thousands of brands in 8 countries, as expected, winning brands gain loyalty over the longer term and the loyalty of declining brands decreases. However, as well as an 80% chance of continued decline after the last recession, it seems that loyalty to losing brands dropped much more than ‘normal’.

- Analysing thousands of categories in 7 countries over the last recession, there doesn’t seem to be a particular type of category where PL increased the most – the growth was very similar in the fastest and slowest growing categories and the largest and smallest categories.

- There are differences in Private Label success when analysed in categories featuring the biggest brand winners and losers.

This means that it is the positive or negative dynamics of individual brands that impact PL share.

Turning to the latest FMCG trends, we now have the first quarter of 2020 for a wide range of countries and are tracking others week by week: - Compared with a stable market in 2019, we see substantial gains in FMCG value and volume in the first quarter and, of course, in March with pre-lockdown stocking up.

- We continue to see growth for FMCG as we move into lockdown, largely with lower shopping frequency and larger basket sizes. It is also worth noting that whilst online purchasing is increasing fast, this compares with a very dynamic total market and shares are not rising as much as many expected.