FMCG for the first half of 2022 shows the expected declines and increased prices

BUT the declines compare with record market levels in the last two years and are also linked to less working from home than last year.

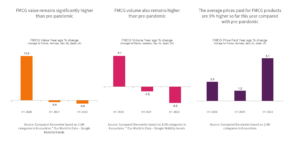

FMCG value remains significantly higher than pre-pandemic

Compared with the first half of 2019, FMCG this year is more than 10% higher in value. There are declines in 2022 despite the current inflation, but these compare with peaks in 2020 and 2021. A key driver is people at home which is 5% lower than the first half of 2021 but still 4% higher than pre-pandemic*

FMCG volume also remains higher than pre-pandemic

Compared with the first half of 2019, FMCG volumes this year are still 2% higher despite current inflation. As with value, there are current declines but these compare with high levels in 2020 and 2021. Fewer people at home is again a key driver and visitors to the workplace have risen 14% since last year although they remain 15% lower than pre-Covid*

The average prices paid for FMCG products are 9% higher so far this year compared with pre-pandemic

Compared with the first half of 2019, the average price paid in FMCG is nearly 9% higher. Naturally the current high inflation rates are key but they build on some inflation in the last two years.