One more set of insights focusing on how price (changes) impacts choice.

All from scientific learnings across our network of marketing academics.

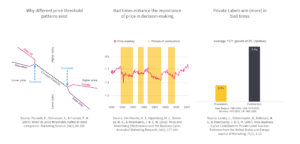

Why different price threshold patterns exist

We showed last week that price elasticities vary across different price points once certain thresholds are met. Four threshold patterns are shown in the chart:

Sales lift: categories/brands that are expensive (allows more people to buy) or with high price volatility (waiting for deals).

Saturation: low frequency categories and where consumers don’t want or can’t store more.

Loyalty: large and differentiated brands.

Sales drop: high price volatility as consumers lie in wait for deals.

Bad times enhance the importance of price in decision-making

A study investigated how the price elasticity of brands varies dependent on the economic climate. Across multiple up and down periods the authors find that the sensitivity to price across 163 brands in 37 categories is substantially higher when times are difficult. The typical elasticities around (minus) 1.1 tend to drop to (minus) 1.3. Make sure you know this – both when contemplating price increases or decreases in such periods. The study was set in the UK.

Private Labels win (more) in bad times

A study investigating PL growth over multiple decades across four countries showed that PL growth year-to-year is more than three times higher in years when the economy contracts as opposed to years when it expands. Manufacturers should also realize that in the past their cyclical reactions to the state of the economy (e.g. cutting advertising or innovation in bad times) did support that pattern, especially with retailers focusing even more on PL.