Does size matter for brand portfolios?

Manufacturers rely on one or more brands in their efforts to capture and grow their share of the category pie. How the number of brands sold by a manufacturer, their relative price position, and the overlap between their respective buyers impacts success is the focus of our current thought leadership initiative. We share some first learnings in this blog, more insights will follow shortly.

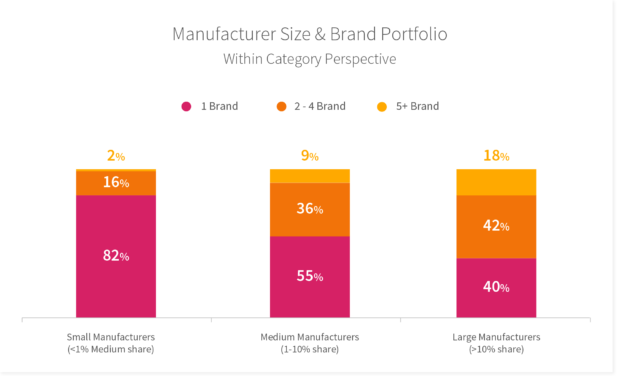

Across 10 countries we find that more than three out of four manufacturers compete with only one brand in one of the 90 categories we consistently track in our BG20 database. Another 20% of manufacturers market two to four brands and only 3% sell five or more brands. Not surprisingly, we find that the larger the number of brands owned by a manufacturer, the larger the category share captured. On average one additional brand in the portfolio increases market share by about 0.6%.

compete with only one brand in one of the 90 categories we consistently track in our BG20 database. Another 20% of manufacturers market two to four brands and only 3% sell five or more brands. Not surprisingly, we find that the larger the number of brands owned by a manufacturer, the larger the category share captured. On average one additional brand in the portfolio increases market share by about 0.6%.

Is having more brands a sufficient and necessary pathway to higher share? Absolutely not. 40% of the large manufacturers (more than 10% category value share) achieve all of their sales with one brand only and only 1 in 5 in this group sells 5 brands or more. At the same time, almost one half of all manufacturers that sell five brands or more do not even capture one percent of their category’s value. Overall, only 15% of all manufacturers surpass the threshold of 1% category market share and almost half of them do so with one brand only.

Countries: Austria, Germany, France, Hungary, Ireland, Poland, Romania, Russia, Spain, UK